Going Infinite By Michael Lewis Summary and Analysis

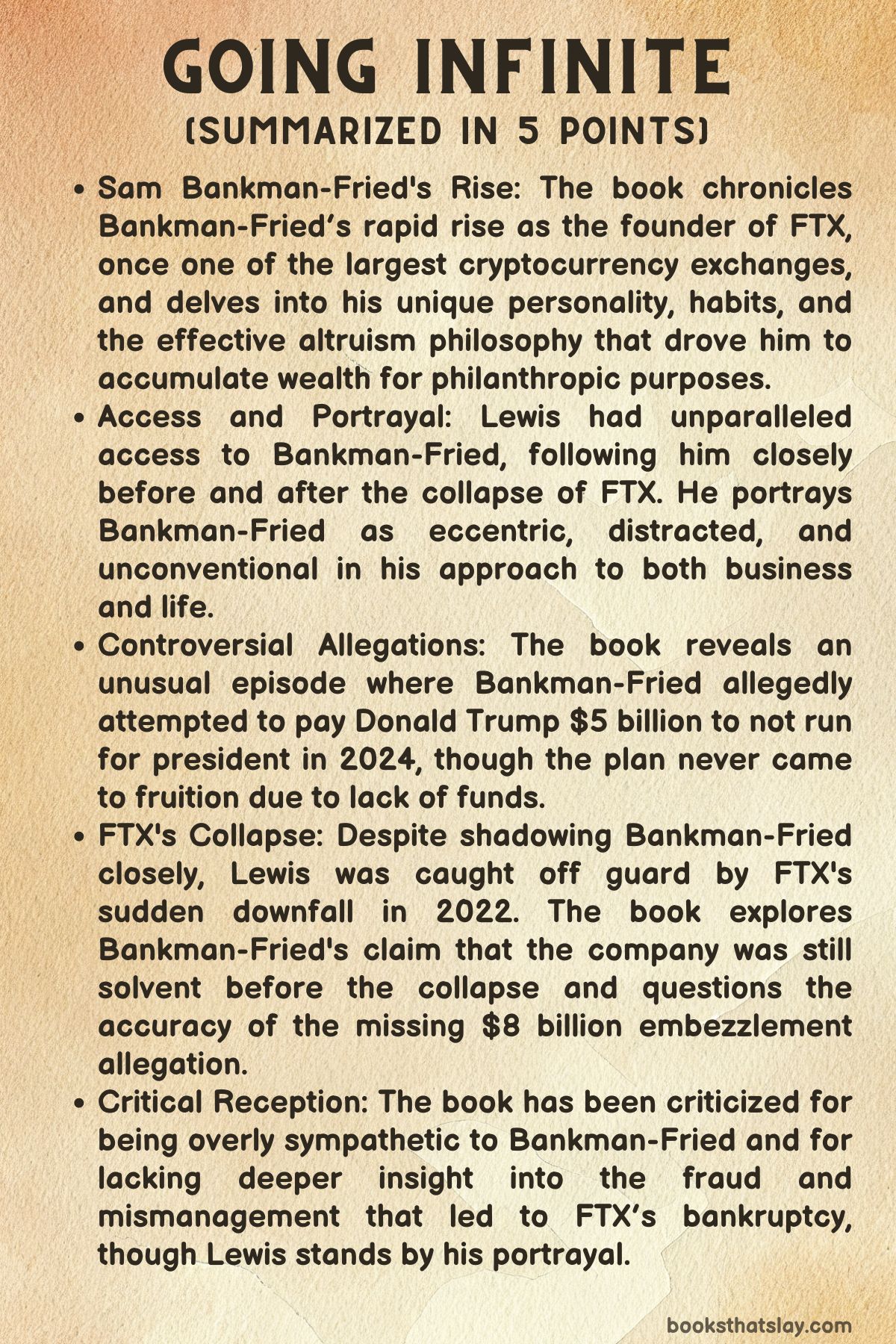

Going Infinite: The Rise and Fall of a New Tycoon is a 2023 book by renowned author Michael Lewis that delves into the extraordinary rise and abrupt downfall of Sam Bankman-Fried, the founder of the failed cryptocurrency exchange FTX.

Published in 2023, to coincide with the beginning of Bankman-Fried’s fraud trial, the book offers a behind-the-scenes glimpse of his eccentric personality, his ambitions, and the mismanagement that led to FTX’s implosion. Despite Lewis’ intimate access to Bankman-Fried, the book has been met with criticism for being too sympathetic towards its subject.

Summary

Michael Lewis first crossed paths with Sam Bankman-Fried in 2021 when Brad Katsuyama, the head of IEX stock exchange, introduced them. Katsuyama was considering selling a stake in his exchange to FTX and enlisted Lewis to look into Bankman-Fried’s operations.

Lewis’s initial impression was positive; he saw Bankman-Fried as driven and intelligent but not overblown in his ambitions. As the book unfolds, Lewis focuses deeply on Bankman-Fried’s idiosyncrasies.

Bankman-Fried, often portrayed as absent-minded and eccentric, was someone who could be absorbed in video games while handling high-stakes business decisions.

He appeared far from the image of a typical business tycoon, with a disheveled appearance and an unorthodox work ethic. His passion for effective altruism is also highlighted, as he expressed a desire to accumulate vast wealth only to donate it for global good.

One of the more intriguing revelations in Going Infinite is Bankman-Fried’s alleged attempt to influence Donald Trump’s political ambitions. The book claims that Bankman-Fried entertained the idea of paying Trump to refrain from running for president again in 2024.

While Bankman-Fried could not gather enough capital to follow through, Trump’s team reportedly indicated that the cost for such a deal would be an astonishing $5 billion.

This quirky episode is emblematic of Bankman-Fried’s blend of ambition and idealism, mixed with a certain naivety about real-world power.

Lewis recounts the dramatic period leading up to FTX’s collapse in late 2022. He had been shadowing Bankman-Fried for most of that year, but despite his insider’s view, he was blindsided when the cryptocurrency exchange suddenly crumbled under the weight of scandal and financial mismanagement.

As FTX spiraled into bankruptcy, prosecutors alleged that $8 billion had been embezzled, but Bankman-Fried insisted he had acted in good faith, and Lewis’s narrative seems to lean toward giving him the benefit of the doubt. According to the author’s rough calculations, FTX may not have been in as dire a financial situation as claimed by prosecutors.

Instead, Lewis suggests that the company was possibly solvent right up until the moment of its collapse, calling into question the nature of the missing billions.

The book does not shy away from the controversies surrounding FTX’s downfall, though it offers a perspective that is far less damning than that of the legal system.

Lewis is critical of John J. Ray III, the executive tasked with managing FTX’s finances after its bankruptcy, implying that his handling of the post-collapse chaos was more damaging than helpful.

Throughout, the reader is left with an impression of Bankman-Fried as someone who, despite his flaws and misguided decisions, did not set out with malicious intent.

Ultimately, Going Infinite paints a portrait of a complex figure who rocketed to prominence in the world of cryptocurrency before crashing spectacularly, but it stops short of outright condemnation, leading some critics to question whether the book provides enough critical distance from its subject.

Analysis

The Complexity of Moral Ambiguity and Its Narratives in High-Stakes Financial Scandals

One of the central themes of Going Infinite is the moral ambiguity surrounding figures like Sam Bankman-Fried, particularly in high-stakes financial environments where the lines between fraud and incompetence blur.

Lewis portrays Bankman-Fried not as a clear-cut villain but as someone whose actions, while resulting in disaster, may not have been driven by malicious intent.

This moral complexity is amplified by the portrayal of Bankman-Fried as someone who genuinely believed in effective altruism—a philosophy that seeks to maximize positive impact in the world—and acted in good faith, even as his actions led to the collapse of FTX and the loss of billions.

The book suggests that the scale of the disaster may have been more a result of recklessness, distraction, and poor decision-making than deliberate fraud.

By refraining from casting judgment, Lewis encourages readers to consider whether Bankman-Fried’s culpability lies in ethical negligence or active deception. This nuanced take complicates conventional narratives about financial criminals.

The Fragility of Financial Systems and the Elusiveness of Solvency in a Hyper-Digitized Economy

Another intricate theme explored in Going Infinite is the precariousness of modern financial systems, particularly in the realm of cryptocurrency.

Lewis examines the volatility of the FTX exchange and suggests that the company’s solvency was not as clear-cut as prosecutors alleged.

By pointing out that the billions of dollars thought to be embezzled were, according to Bankman-Fried’s own understanding, still present in the system, Lewis highlights the difficulty of assessing solvency in a highly digitized, rapidly evolving financial space.

This theme underscores how easily financial systems can collapse under their own complexity, especially when built on assets as fluid and intangible as cryptocurrencies.

Lewis’s portrayal of FTX as “arguably solvent right up until its collapse” challenges the reader to consider how solvency and liquidity—concepts that are usually treated as fixed—are often elusive and hard to quantify in the world of high-speed trading and digital finance.

The Ethical Paradoxes of Effective Altruism in the World of Hyper-Capitalism and Wealth Concentration

A critical and thought-provoking theme that Lewis delves into is the ethical paradox of effective altruism when intertwined with the aggressive wealth accumulation of hyper-capitalism.

Bankman-Fried’s philosophy of effective altruism, which involves earning as much money as possible to then use it for the greatest possible good, creates a tension between philanthropic intent and the potentially exploitative nature of the means by which that wealth is acquired.

Lewis explores how this philosophy might have contributed to Bankman-Fried’s moral blind spots. It may have allowed him to rationalize risky or questionable behavior in the service of an ostensibly noble goal.

The book raises questions about whether the pursuit of immense financial power can ever be ethically aligned with altruism. This is especially relevant when the systems that generate that wealth—such as cryptocurrency trading platforms—are inherently unstable and exclusionary.

This theme forces readers to grapple with the contradiction between high-minded ethical ideals and the cutthroat reality of global financial markets.

The Role of Eccentricity, Distraction, and Personality in Corporate Leadership and Catastrophic Failure

Lewis provides an intimate psychological portrait of Bankman-Fried, revealing how his eccentricity, distracted nature, and obsession with probability games played a central role in FTX’s eventual collapse.

This theme goes beyond the surface level of Bankman-Fried’s personal quirks and dives into the deeper question of how personality traits can affect corporate governance and decision-making in high-risk environments.

The book presents Bankman-Fried as a figure who, while brilliant in some respects, was ill-suited for the immense responsibilities of managing a multi-billion dollar company. His distracted leadership style, marked by chaotic personal habits and an inability to focus on critical details, becomes a metaphor for the larger disarray within FTX itself.

Lewis uses this theme to reflect on the broader question of how leadership in today’s fast-paced, tech-driven industries often places enormous power in the hands of individuals. These individuals may have personal characteristics that do not align with the demands of their roles, leading to catastrophic failures.

The Intersection of Political Power and Finance: Influence, Bribery, and the Ethics of Political Manipulation in the Digital Age

A more contentious theme in Going Infinite involves the intersection of political power and finance, particularly the allegation that Bankman-Fried attempted to bribe Donald Trump to not run for president again.

This theme sheds light on the blurred lines between financial influence and political manipulation, highlighting how figures in the financial world may attempt to shape political outcomes through wealth.

Lewis explores this through Bankman-Fried’s alleged backchannel negotiation with Trump’s team. He emphasizes the ethical dilemmas inherent in such attempts at political interference.

By discussing this in the context of the digital age, where financial actors often have outsized influence over political events, the book touches on the broader concern of how wealth concentration and corporate power increasingly threaten democratic processes.

The theme asks the reader to reflect on the ethical implications of using vast financial resources to alter political trajectories. It questions whether such attempts are an inevitable consequence of the way power operates in hyper-capitalistic societies.

The Limitations of Journalistic Objectivity and the Challenges of Reporting in Real Time During Financial Crises

Lewis’s portrayal of his own relationship with Bankman-Fried introduces another reflective theme on the limitations of journalistic objectivity. This is particularly significant when covering figures who occupy morally ambiguous spaces.

The book raises the question of how much access can cloud a journalist’s ability to see the truth. Lewis admits that he did not suspect wrongdoing and remained close to Bankman-Fried even as the FTX scandal began to unfold.

This theme forces readers to consider the ethical challenges of reporting on high-profile individuals in real time, especially when the journalist is granted unparalleled access.

Lewis’s retrospective account of how he was “caught off guard” by FTX’s collapse serves as a critique of the often tenuous position that journalists occupy when they become enmeshed with their subjects. It highlights the struggle to maintain distance and perspective in the face of overwhelming access and personality-driven narratives.

This theme is particularly relevant in an era where the media frequently finds itself embedded within the stories it is meant to objectively report.