1929 by Andrew Ross Sorkin Summary and Analysis

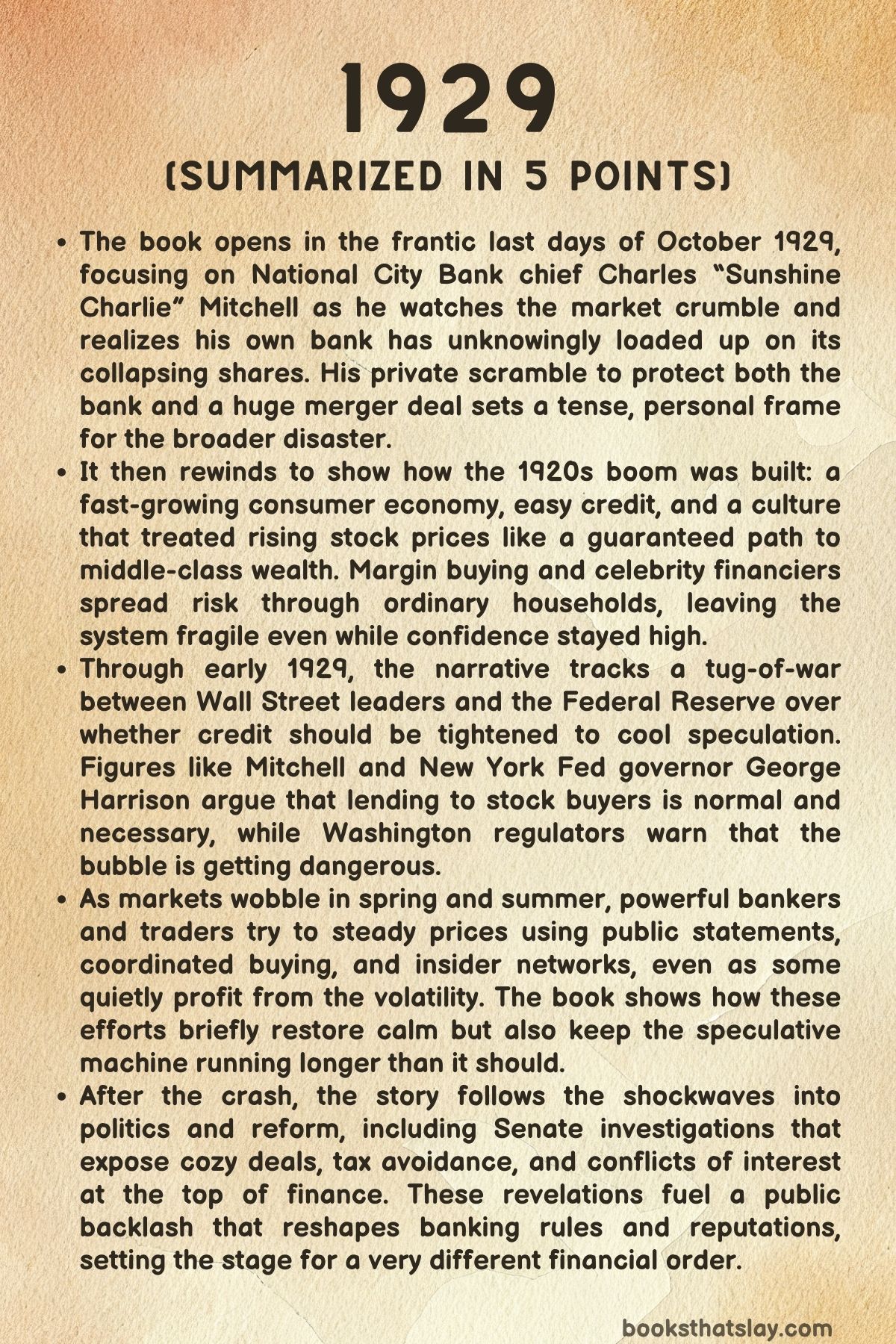

1929 by Andrew Ross Sorkin is a narrative history of the year the American stock market cracked and the political, banking, and personal forces that made the crash possible. The book follows a tight cast of bankers, speculators, regulators, and public officials as prosperity turns into panic.

Sorkin shows how the 1920s credit boom, margin buying, and a culture that treated stocks like a fast path to status pushed the system past its limits. By focusing on decisions made in real time—often with incomplete information—the book explains how confidence failed, how rescue efforts worked and failed, and how the aftermath reshaped U.S. finance.

Summary

The story opens on Monday, October 28, 1929, after the market closes down about 13 percent. Charles “Sunshine Charlie” Mitchell, chairman of National City Bank, heads back to 55 Wall Street through streets jammed with frightened traders and employees trying to guess what comes next.

He has just spent hours in emergency meetings at the New York Federal Reserve. Mitchell is famous for his upbeat certainty, but the scale of the selloff rattles him.

Once inside the bank, he goes straight to Hugh Baker, who runs National City’s trading desk. Baker reports that the desk has been buying large amounts of National City stock throughout the crisis.

Under pressure, he admits they bought more than seventy thousand shares. Mitchell immediately sees the danger: those purchases were not optional.

Weeks earlier he had engineered National City’s takeover of Corn Exchange Bank, a deal that depended on National City stock staying high. Corn Exchange shareholders could take cash or stock based on National City’s price.

If the stock fell too far, many would demand cash, and National City did not have enough. To keep the merger from collapsing, Mitchell had quietly instructed the desk to buy the bank’s stock whenever it dipped.

But the panic on October 28 was too fast. The ticker lagged so badly that nobody knew real prices, and sell orders flooded in.

National City’s support bids got hit instantly, and the desk lost track of how much it had taken on. Now the bank is stuck with about seventy-one thousand shares, costing roughly $32 million—an enormous sum for a bank that cannot legally borrow against its own stock.

Those shares sit like a stone on the balance sheet. If National City tries to unload them quickly, it could signal weakness, invite short sellers, and start rumors that the biggest bank in the country is unsafe.

Mitchell remembers 1907, when fear alone brought depositors to the doors. He worries that another run could destroy the institution he built.

Mitchell, Baker, and bank president Gordon Rentschler ride uptown in Mitchell’s Rolls-Royce, each trying to imagine how to stop the slide. They agree that Tuesday could be worse, yet no plan seems workable.

That night Mitchell still attends a high-profile dinner at Bernard Baruch’s home honoring Winston Churchill. He believes skipping it would look like he is hiding.

He barely sleeps. Early Tuesday, October 29, headlines scream about billions erased.

His photo appears beside political attacks on Wall Street excess. Walking downtown with Rentschler, Mitchell admits a desperate idea: he will borrow $12 million in his own name, buy the unwanted shares from National City, and remove the deadweight.

Rentschler pleads with him not to risk his fortune or family and warns that if the move leaks it might deepen panic. Mitchell refuses to back down—something must be done before the market opens.

From there the narrative rewinds to show how the country arrived at this brink. The 1920s transformed the U.S. economy: millions moved to cities, factories built cars, radios, and household goods, and a new consumer culture encouraged people to buy now and pay later.

Credit spread everywhere, and Wall Street carried that logic into stocks. Margin accounts let ordinary Americans purchase shares with borrowed money, so rising prices felt like easy prosperity.

Middle-class savers became speculators, brokers became celebrities, and faith in endless growth replaced caution. Underneath, the system was supported by debt and fragile confidence.

By early 1929, concern about runaway speculation reaches the Federal Reserve. Washington officials issue warnings urging banks to curb loans feeding the stock boom.

The New York Fed, closer to Wall Street, resists blunt intervention. Call-money rates rise as the Fed tries to make borrowing for stocks less attractive.

Mitchell, both National City president and a New York Fed director, argues that stock credit is as normal as auto credit. He fights efforts to sharply raise rates, helping keep money flowing into the market.

Speculation becomes a nationwide habit; even clerks and small savers pile in. Some bankers complain about “unsuitable” investors, but Mitchell’s strategy depends on welcoming them.

When a February drop shakes confidence, he phones fellow booster William C. Durant, and together they blame the Fed for choking prosperity. Mitchell wants political pressure placed on President-elect Herbert Hoover to rein in the regulators.

Hoover’s March inauguration briefly lifts spirits, yet cracks are visible. Noted trader Jesse Livermore senses that prices have outrun reality.

In late March he launches a quiet short-selling attack that triggers a fast break. Volumes explode, the ticker falls behind, leading stocks tumble, and call money briefly reaches 20 percent.

Brokerage houses demand extra margin, forcing sales that feed the fall. Mitchell decides to act as rescuer.

He tells New York Fed governor George Harrison that National City will lend freely to support stock buyers and is assured eligible loans will not be blocked. Word of his pledge spreads, selling slows, and the market snaps back.

Newspapers print his promise to provide liquidity, making him the public face of confidence.

Washington reacts angrily. Officials see Mitchell’s intervention as defiance that revives the very frenzy they are trying to cool.

Senator Carter Glass, already furious at Wall Street gambling, singles Mitchell out as a symbol of reckless finance. Meanwhile, inside the boom, pools and insider deals flourish.

Glamour stocks such as RCA are pushed higher by coordinated buying, then dumped for profit, showing how manipulated the market has become.

The crisis finally erupts in October. On Thursday, October 24, selling overwhelms the New York Stock Exchange.

Acting president Richard Whitney, under orders from leading banks, makes a theatrical stand by loudly buying huge blocks of blue-chip shares at above-market prices. The show steadies prices for a few hours, and the bankers’ pool spends around $20 million trying to create bids where none exist.

The Dow ends the day bruised but not broken, and Whitney is praised as a savior. Yet behind the scenes firms struggle to execute customer orders, and small investors watch fortunes vanish, even from shipboard brokerages at sea.

Friday and Saturday look calmer, tempting bankers like Thomas Lamont of J. P. Morgan & Co. to believe the storm has passed.

But on Monday the 28th, the market breaks again, more violently. The pool admits it cannot defend everything.

National City stock falls into the danger zone for Mitchell’s merger gamble, and his desk buys far more than intended. Mitchell’s personal rescue plan goes forward on Tuesday the 29th: he secures a large loan from Morgan, purchases tens of thousands of National City shares for himself, and uses some as collateral.

Even so, the market collapses in historic volume. Exchange governors debate closing the market but fear that shutting it would create chaotic street trading and freeze collateral loans, so they keep it open while shortening hours.

The fallout spreads through November. Lamont fumes that National City abandons the Corn Exchange merger, worsening distrust among the big banks.

A prominent trust-company president, crushed by margin debts and withdrawals, takes his own life, and friends scramble to prevent another run. Livermore, who profited by betting against the boom, receives threats and hires guards.

Government leaders meet Hoover to argue over the right response. Treasury Secretary Andrew Mellon urges liquidation to purge excess, while others fear a wider collapse.

Public reassurance cannot stop the downward drift. Confidence keeps eroding through 1930 and beyond, turning the crash into a long economic breakdown marked by bank failures, shrinking credit, and mass unemployment.

The book then follows the political reckoning. By 1933, Senate investigations led by Ferdinand Pecora expose insider lending, preferential stock deals, and tax avoidance at major firms, especially the House of Morgan.

Public anger hardens into support for reform. Senator Glass and Representative Henry Steagall clash over deposit insurance and how far to separate commercial banking from securities trading.

President Franklin Roosevelt pushes for strict separation and a federal guarantee for deposits. The Glass–Steagall Act becomes law in June 1933, mandating a firewall between investment and commercial banking and creating federal deposit insurance.

In the same period, Mitchell faces a tax-fraud trial. Though many Americans view his conduct as emblematic of the boom’s moral failures, a jury acquits him, provoking outrage and reinforcing the sense that the system had protected its own.

An epilogue shows the lingering collapse of old Wall Street codes, as Richard Whitney is later exposed for stealing securities to cover personal losses and is sent to prison, a final symbol of the era’s broken trust.

Key People

Charles “Sunshine Charlie” Mitchell

Charles Mitchell stands at the center of 1929 as both a symbol and an engine of the credit-fueled boom. Outwardly genial and relentlessly optimistic, he has built his public identity on confidence—so much so that he treats confidence as a form of capital that must be guarded at any cost.

His driving belief is that democratized investing and easy credit are not reckless but modern, even patriotic, extensions of consumer prosperity. That conviction makes him a fierce opponent of Federal Reserve tightening and a promoter of margin lending, but it also narrows his vision: he interprets market declines less as warnings than as problems to be managed with more liquidity and showmanship.

When the crash arrives, his bravado turns into private panic, revealing a man whose power depends on keeping appearances intact. His decision to borrow personally and absorb National City stock shows both genuine responsibility and a dangerously personal fusion of ego, institution, and market.

Later, in the political aftermath, Mitchell becomes a scapegoat for a system he helped popularize, and his trial highlights the gap between legality and public morality. He emerges as a tragic figure of modern finance—innovative, charismatic, and fatally convinced that credit and confidence can override structural limits.

Hugh Baker

Hugh Baker, head of National City’s stock-trading operation, represents the practical, desk-level reality beneath Mitchell’s grand strategy. He is not portrayed as ideological so much as operationally loyal, executing the bank’s quiet policy of supporting its own share price to protect the Corn Exchange merger.

In the chaos of October 28, his unit buys far more stock than intended, and his admission to Mitchell reveals a man caught between obedience and the sheer speed of panic markets. Baker’s importance lies in how he embodies institutional momentum: once a policy is set in motion, even capable managers can lose control under extreme volatility.

He is less a villain than a reminder that systems built on constant intervention become brittle when intervention suddenly scales beyond anyone’s tracking ability.

Gordon Rentschler

Gordon Rentschler, National City’s president, plays the role of sober counterweight to Mitchell’s impulsive resolve. He understands the psychological fragility of banking crises, especially the way rumors can become self-fulfilling runs.

His plea for Mitchell not to risk his fortune underscores his prudence and his clearer separation between personal and institutional stakes. Yet he is also trapped in the same predicament as Mitchell: he can see the cliff edge but has no clean exit.

Rentschler’s character highlights how, in a leveraged system, even the cautious are forced into complicity with risk because the institution’s survival depends on maintaining market faith.

Thomas Lamont

Thomas Lamont functions as a diplomatic banker, power broker, and guardian of elite finance. He moves comfortably between Wall Street, Europe, and Washington, illustrating how banks in the 1920s became unofficial arms of statecraft.

Lamont is portrayed as highly competent and deeply embedded in the era’s optimistic worldview, but also as an architect of its most corrosive practices—especially insider privilege and speculative packaging, such as the Alleghany Corporation deal that gives insiders steep discounts while the public pays more. During the crash, he becomes a manager of optics and collective action, helping organize the bankers’ pool and projecting calm to hold the line on confidence.

His fury at Mitchell after the merger collapses reveals the strict internal codes that governed finance: loyalty to the club mattered, and breaking ranks threatened the whole structure. By the epilogue, Lamont appears as a relic of an older Wall Street morality—protective of peers even when silence enables wrongdoing—showing how the same elite solidarity that once stabilized markets later undermined legitimacy.

Florence Lamont

Florence Lamont appears briefly but meaningfully as part of the social world that surrounds power. Traveling with Lamont on the Aquitania, she signals the comfort and international prestige that high finance enjoyed at its peak.

Her presence reinforces that this is not merely a financial story but a cultural one: bankers lived as global aristocrats, and their domestic lives were intertwined with their professional authority.

J. P. “Jack” Morgan

Jack Morgan is the hereditary figurehead of J. P. Morgan & Co., inheriting both aura and institutional dominance. Though Lamont effectively runs the firm, Jack’s control inside the partnership—exposed later in the Pecora hearings—shows the inner autocracy of a house that publicly projected restraint and civic duty.

His appearance before Congress reveals a man accustomed to privacy and deference, suddenly forced into transparency. The shock over Morgan partners paying no income tax makes him emblematic of elite insulation from ordinary rules, intensifying public anger.

Jack Morgan stands for the old financial order whose legitimacy depended on secrecy and presumed virtue, an order that collapses under democratic scrutiny.

George Harrison

George Harrison, governor of the New York Fed, is portrayed as a pragmatic central banker trying to steer between a runaway market and an overreaching Washington board. He argues that regulators cannot reliably trace how credit is used and pushes for modest rate changes to cool speculation without detonating confidence.

His stance reveals a technocrat’s fear of blunt instruments: he prefers gradualism and local judgment. Yet his limited success also shows the Fed’s structural weakness in 1929—split authority, reliance on “moral suasion,” and political vulnerability.

Harrison becomes the voice of cautious intervention, aware that too much tightening risks disaster but too little invites the very crash he hopes to prevent.

Benjamin Strong

Benjamin Strong appears in retrospect as the ghost of central-bank leadership. His earlier distrust of Mitchell’s ego suggests he recognized how personality could distort policy.

By bringing Mitchell onto the New York Fed board to keep him close, Strong represents an older style of governance based on personal management of powerful men rather than formal constraints. His legacy implicitly raises the question of whether the system lost a stabilizing force when such leadership disappeared.

Edward Benedere

Edward Benedere is a smaller but revealing character who gives voice to elitist anxiety about mass participation in markets. His complaint that clerks and women are crowding into stocks exposes how the boom unsettled traditional hierarchies.

He wants barriers to entry not for economic reasons but to preserve a social order, and his stance throws Mitchell’s democratizing salesmanship into sharper relief. Benedere therefore functions as a cultural marker of the era’s tension between old gatekeepers and new retail capitalism.

William C. Durant

William C. Durant, former GM founder turned speculator, embodies the restless, high-voltage capitalism of the decade. He shares Mitchell’s belief that the Fed is choking prosperity and helps connect Wall Street lobbying to political power.

His involvement in insider pools around RCA shows his comfort with aggressive, manipulative market tactics. Durant is less a strategist of long-term stability than a gambler-industrialist chasing the next surge, illustrating how the era blurred business building and stock-market gaming.

Herbert Hoover

Herbert Hoover appears as the political figure onto whom financiers project hopes and pressures. His inauguration sparks market euphoria, reflecting the belief that a pro-business presidency guarantees rising prices.

Yet his silence on speculation and later cautious reassurances reveal a leader caught between public optimism and private warnings. Hoover’s character in the narrative is defined by restraint and incrementalism—he does not create the crash, but his inability to forcefully redirect policy or mood makes him part of a system that drifts into catastrophe.

Jesse Livermore

Jesse Livermore is the pure market predator of 1929, a trader who reads crowd psychology with clinical detachment. His disguised short raid in late March shows both tactical brilliance and moral indifference to the consequences of panic.

After the crash, he becomes a paradoxical celebrity: hated enough to receive threats, yet respected for seeing what others could not. His mid-November call to buy again underscores his contrarian nature and his belief that markets are cyclical machines, not moral projects.

Livermore represents the era’s dark mirror—proof that in a speculative system, disciplined cynicism can beat mass hope.

Elliott Bell

Elliott Bell, the reporter who prints Mitchell’s pledge to lend, illustrates the decisive role of media in financial crises. By broadcasting Mitchell’s promise, he does not merely report events; he shapes them, helping to slow selling through public reassurance.

Bell’s presence shows how words and headlines became direct market forces in 1929, making journalists inadvertent participants in policy and panic.

Senator Carter Glass

Carter Glass is the narrative’s most persistent moral and institutional antagonist to Wall Street excess. He is outraged by the revival of speculation after Mitchell’s rescue and sees credit-driven stock gambling as a national betrayal.

Yet his character is complex: while he wants reform, he also instinctively defends Morgan’s reputation during the Pecora hearings, revealing his lingering respect for old financial elites. His fierce opposition to deposit insurance, grounded in fear of moral hazard, shows a principled but rigid devotion to traditional banking discipline.

Glass’s arc culminates in the Glass–Steagall Act, making him both a critic of the crash era and an architect of its regulatory aftermath.

Michael Meehan

Michael Meehan, the specialist who runs a pool pushing RCA upward, personifies the engineered side of speculation. He operates in the shadowy space where market making becomes market manipulation, leveraging glamour stocks and insider coordination for outsized profit.

Meehan’s role underscores that the boom was not only a mass delusion but also a set of deliberate, organized price games played by professionals who expected to exit before collapse.

Walter Chrysler

Walter Chrysler appears as a respected industrial insider drawn into speculative pools. His involvement reinforces how even legitimate builders of the real economy were tempted into financial schemes, blurring lines between productive enterprise and stock promotion.

He serves as evidence that the crash was rooted in a culture that captivated almost every tier of success.

Bernard Baruch

Bernard Baruch functions as a social anchor of elite power. Hosting a high-profile dinner during market free-fall, he provides a stage where financiers attempt to maintain composure and mutual reassurance.

Baruch’s world is one where private gatherings and public perceptions interlock; the dinner itself becomes a tactic of stability, showing how Wall Street managed crisis through rituals of confidence as much as through capital.

Winston Churchill

Winston Churchill appears as an observing outsider whose presence heightens the symbolic stakes. His remarks about the Exchange’s eerie calm amid forced selling add an international, almost historical lens to the crash, suggesting that even global statesmen saw the event as a civilizational tremor.

He is less an actor in finance than a witness to its drama.

Richard Whitney

Richard Whitney is the crash’s theatrical hero-turned-cautionary tale. His famous floor intervention on October 24 makes him “Wall Street’s White Knight,” displaying courage and a gambler’s instinct for spectacle.

Yet his hidden personal debts and later criminal unraveling expose the fragility beneath that bravado. Whitney represents the broader pattern of 1929: public confidence propped up by private leverage.

His eventual imprisonment shows that the ethics of the old Exchange culture—club loyalty, silence, and risk-taking—could no longer survive the new regulatory and public order.

Charles Merrill

Charles Merrill appears as a businessman suddenly confronted by the operational breakdown of panic. Discovering that his broker failed to execute customer sell orders, he faces the terrifying possibility that a procedural delay could destroy his firm.

Merrill’s role highlights how the crash was not only about prices but also about infrastructure: the market’s machinery could not keep pace with fear. He comes off as practical and survival-oriented, emphasizing the human vulnerability behind institutional names.

Lewis Pierson

Lewis Pierson is one of the establishment voices urging calm in the early crash days. His statements show the old strategy of reassurance—confidence as preventative medicine.

Pierson’s presence emphasizes how leading bankers initially believed stabilization was possible through coordinated messaging, reflecting both their experience and their overconfidence in contained crises.

John D. Rockefeller Sr.

Rockefeller serves as a national patriarch whose calm words are meant to steady ordinary investors. His intervention illustrates how deeply public morale relied on the perceived wisdom of titans.

Yet the limited effect of such statements suggests that by 1929 the market had grown beyond anyone’s ability to soothe with reputation alone.

James Riordan

James Riordan, president of County Trust, becomes a stark embodiment of personal ruin in systemic collapse. Overwhelmed by margin debts and depositor withdrawals, he commits suicide, showing the psychological toll of leverage and loss.

His death also reveals the fragility of mid-tier banks caught between speculative exposure and public panic. Riordan’s story adds a human tragedy to the macroeconomic catastrophe, illustrating that the crash reduced real people—not just balance sheets—to despair.

John Raskob

John Raskob is a fixer and political operator straddling finance and public life. By delaying news of Riordan’s suicide, ordering an audit, and securing Fed support, he acts swiftly to prevent a bank run, showing acute understanding of confidence dynamics.

His later need to cover Riordan’s political loan reveals the messy entanglement of banking, politics, and personal obligation. Raskob represents the era’s hybrid elite who could mobilize both financial tools and back-channel influence to manage crises.

Al Smith

Al Smith appears as Raskob’s ally in stabilizing County Trust, reinforcing his role as a political heavyweight with stakes in Wall Street’s credibility. His involvement underscores the interdependence of finance and party politics in the crash era: protecting a bank was also protecting reputations, networks, and electoral futures.

Andrew Mellon

Treasury Secretary Andrew Mellon embodies the hard-line orthodoxy that framed the crash as a purge. His warning to Hoover and his belief in liquidation as cleansing reflect a worldview where markets are moral correctives and government should avoid cushioning failure.

Mellon’s stance helps explain why early federal responses were hesitant and why the downturn deepened—he becomes the voice of austerity at the moment when flexibility was desperately needed.

Roy Young

Roy Young, a Fed governor, appears as part of the Washington policy circle warning Hoover of contagion. He is less individualized than Mellon, but his presence illustrates the institutional alarm spreading beyond Wall Street.

Young represents the official system becoming aware of disaster while still unsure how to respond.

Winthrop Aldrich

Winthrop Aldrich enters the narrative during reform as a strategic rival to Morgan and a key shaper of Glass’s bill. By drafting strict separation language, he pushes legislation to a hard edge, driven by both genuine belief in reform and competitive advantage for Chase.

Aldrich shows how post-crash regulation was not purely moral correction but also a battlefield of banking interests, where principle and rivalry advanced together.

Franklin D. Roosevelt

Franklin Roosevelt appears as a political realist harnessing public anger to remake banking. He insists on Aldrich’s tougher separation, backing sweeping reform even when it strains alliances.

Roosevelt’s break with gold orthodoxy and willingness to void gold clauses show a leader prepared to discard tradition to restore economic functioning. In relation to Glass, he is both partner and provocation: supportive enough to pass the bill, radical enough to unsettle its author.

Roosevelt represents the shift from private-banker dominance to an assertive federal state.

Henry Steagall

Henry Steagall serves as the populist counterpart to Glass’s patrician caution. His insistence on strong deposit insurance reflects a grassroots understanding of panic—that ordinary depositors need guarantees more than lectures on discipline.

Steagall’s political success in the House demonstrates how public sentiment had turned decisively against banking risk, and his role ensures that reform contains not only structural separation but also direct protection for citizens.

Ferdinand Pecora

Ferdinand Pecora is the narrative’s great exposer, wielding interrogation as a form of democratic power. His hearings strip away Wall Street mystique by forcing disclosure of insider deals, partnership control, and tax avoidance.

Pecora is relentless, theatrical when needed, and attuned to public outrage, turning technical abuses into moral spectacle. While Glass worries about a “circus,” Pecora understands that legitimacy requires visibility.

He stands for the era’s demand that finance answer to society rather than to itself.

George Whitney

George Whitney functions as the discreet guardian of old Wall Street loyalty. By informing Lamont about Richard Whitney’s thefts and helping to fund a quiet rescue, he follows the code of protecting insiders through private intervention.

His role shows how the pre-crash culture persisted into the late 1930s—still prioritizing reputation over disclosure—even as regulatory expectations changed.

Speyer

Speyer appears briefly as one of the bankers unnerved by the unfolding disaster, withdrawing after tense discussions. His departure signals the fraying unity of financial elites once confidence operations begin to fail.

Even as a minor character, he reflects the growing sense among some insiders that the machinery of reassurance was no longer sufficient.

Themes

Credit, Leverage, and the Fragility of Prosperity

The story shows a world where prosperity is built less on earned surplus and more on borrowed momentum. The rise of installment buying for cars, radios, and household goods makes debt feel ordinary and even patriotic, a tool for joining modern life instead of a risk to be feared.

That same comfort with credit migrates into the stock market through margin accounts and call money, turning speculation into a mass activity. The summaries highlight how quickly easy borrowing transforms the meaning of market gains: profits appear to be personal brilliance or national destiny, when they are often the product of leverage amplifying every uptick.

This creates a system that looks stable as long as prices rise, but becomes acutely vulnerable the moment prices stall. The panic days reveal this vulnerability in mechanical detail—tickers lag, prices are uncertain, brokers demand more margin, and borrowers must sell to meet calls even if they believe in the underlying companies.

Debt converts hesitation into forced liquidation, and forced liquidation accelerates decline.

What makes this theme especially sharp is that leverage is not confined to small investors. National City’s own strategy depends on supporting its share price to complete the Corn Exchange merger, and that support relies on using the bank’s balance sheet to absorb stock risk.

The bank’s accidental accumulation of seventy-one thousand shares is a perfect symbol of the era’s trap: credit-fueled confidence leads institutions to take positions they cannot unwind without destroying the confidence they need. The summaries also show that official regulators recognize the danger but lack effective tools.

The Federal Reserve’s “moral suasion” and rate debates are too weak for a market hooked on borrowed money. Once the crash begins, credit does not soften the fall; it hardens it, making every participant—ordinary clerks, celebrity financiers, and systemically important banks—part of a single chain reaction.

1929 treats credit as both the engine of the boom and the hidden fuse that makes the downturn explosive.

Performance of Confidence and the Fear Beneath It

Public confidence in this world is not just an emotion; it is a performance that powerful people must stage to keep institutions alive. Charles Mitchell attending Baruch’s dinner for Churchill at the worst moment of market crisis captures how reputation becomes a form of collateral.

He understands that absence would be interpreted as a signal, and with banks dependent on depositor trust, signals can be fatal. Richard Whitney’s dramatic purchase of U.S. Steel on the Exchange floor works the same way.

The act is meant not merely to buy shares but to project steadiness, to be seen by traders, reporters, and the wider public as proof that order still exists. These scenes show that finance in 1929 runs on belief, and belief can be manufactured—at least for a while.

Yet the summaries repeatedly expose how thin that manufactured belief is. Whitney is secretly drowning in personal debt even as he plays savior; Mitchell is shaken and sleepless even as he reassures markets.

Their private fear is not incidental—it is the real state of the system. The need to hide weakness makes responses slower and riskier, because every honest admission could cause the very collapse they dread.

National City cannot sell its own stock holdings without inviting short sellers and rumors; the Exchange governors fear closing the market because the street might invent uncontrolled alternatives. Confidence becomes a cage: actors must keep smiling, keep buying, keep insisting the fundamentals are sound, even when their actions prove they fear the opposite.

The later political and legal fallout extends this theme beyond the crash itself. Pecora’s hearings and the public fury over tax avoidance show a society deciding that elite performances of virtue were masks for self-dealing.

Even Glass, who wants reform, worries about spectacle because spectacle can reshape belief. In this sense, the book suggests that confidence is both a necessary lubricant for markets and a danger when it turns into theater.

The crash happens when theater can no longer substitute for reality, and the reforms that follow are attempts to reduce the power of performance over public fate.

Power, Inside Advantage, and Moral Blindness

A recurring idea is that financial power in this era is concentrated among a small circle that treats the market as something to be guided for its own purposes. The summaries show insiders arranging privileged access to deals—Lamont promoting Alleghany Corporation with a steep discount for friends, banks forming pools to defend prices, specialists running stock operations that lift glamour shares and then abandon them.

None of this is described as a one-off scandal; it is routine, a normal way that high finance functions. The public is encouraged to buy into the boom, but it buys at a different price and with different information.

In 1929, proximity to power changes the rules of the game.

What makes this theme more than a simple critique of greed is the moral blindness that accompanies inside advantage. Mitchell sincerely argues that borrowing for stocks is as legitimate as borrowing for consumer goods.

His conviction is not purely cynical; it is shaped by a worldview where expanding participation and keeping markets rising are identical to national progress. That worldview makes it easy to dismiss warnings as prudish or politically motivated.

Likewise, Morgan partners see discounted shares for influential figures as ordinary relationship-building, not corruption. When Pecora reveals that Morgan partners paid no income tax in 1931–32, they appear shocked by the outrage, as if the public should accept that sophisticated actors naturally optimize rules.

This distance between elite norms and public expectations becomes a driver of historical change. The crash does not just destroy wealth; it destroys the legitimacy of the entire insider culture.

The Mitchell trial ending in acquittal deepens anger because the audience believes legality has diverged from fairness. Glass–Steagall then emerges as a forced recalibration of power—removing the ability of commercial banks to speculate through affiliates and adding deposit insurance to protect ordinary people.

The theme, then, is not only that power corrupts outcomes, but that power can distort moral perception so thoroughly that elites struggle to see why the system is judged intolerable. The reforms are society’s response to that blindness.

Institutions at War: Regulation, Politics, and Competing Visions of Stability

The summaries present stability not as a single goal but as a battlefield where institutions fight over what stability means and who should define it. The Federal Reserve’s early 1929 conflict shows this clearly.

Washington wants to restrain speculative credit, New York fears harming prosperity and doubts regulators can trace how funds are used. Both claim to protect the economy, but they operate from different assumptions about risk, growth, and authority.

Mitchell’s open defiance of the Fed’s warning, and the Fed’s inability to discipline him effectively, reflects a fragmented state where private finance can challenge public control. The crash is partly a result of this mismatch: regulators see danger but cannot coordinate or enforce a response strong enough to change behavior.

Later, the fight shifts into the political arena. Glass and Roosevelt share a desire to reform finance, yet disagree sharply on gold policy and deposit insurance.

Their alliance holds only through negotiation and pressure from public anger. The summaries underscore that reform is not a neat moral correction; it is a contested process shaped by rivalries, egos, and strategic compromises.

Roosevelt’s decision to let Winthrop Aldrich draft key separation language despite Glass’s fury shows political power overriding senatorial ownership. Steagall’s insistence on stronger deposit guarantees over Glass’s objections shows democratic pressure from depositors reshaping elite plans.

Pecora’s investigation acts as a catalyst by turning hidden practices into public facts. That exposure changes the balance of power: bankers’ arguments for gradual change fail because the nation has lost patience with internal self-policing.

Glass–Steagall’s final form, with strict separation and federal insurance, is the institutional answer to a decade of regulatory weakness and private dominance. Even the epilogue about Richard Whitney’s theft and the silent rescue attempts by Lamont and George Whitney highlights the lingering conflict between old Wall Street codes and new expectations of transparency.

1929 thus frames the Depression-era shift as a struggle between competing guardians of stability, where the eventual victory of reform comes not from clean consensus but from crisis forcing a new settlement.