I Will Teach You To Be Rich Summary and Key Lessons

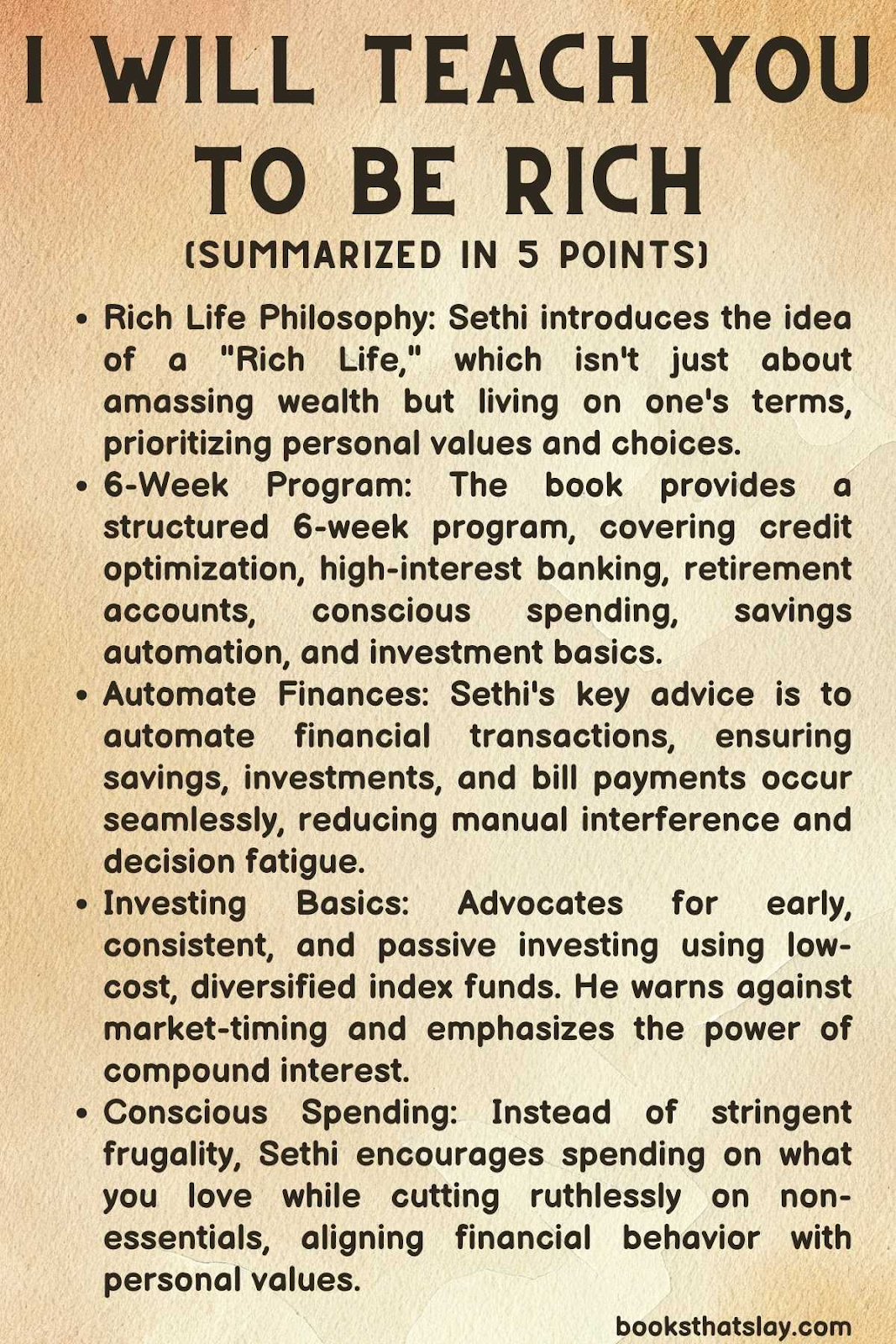

“I Will Teach You To Be Rich” by Ramit Sethi, published in 2009, is a practical guide to personal finance for young adults, combining behavioral insights with actionable advice,

Quick Summary: The book offers practical advice on managing finances for young adults. Emphasizing automation, it guides readers on saving, investing, and spending consciously. Covering topics like credit cards, student loans, and retirement funds, it promotes a balanced approach to wealth and a rich life.

Full Summary

Foundational Principles

At the outset, Sethi introduces readers to the core philosophy behind his approach: The concept of a “Rich Life.”

A Rich Life is subjective and varies for each person; it’s not just about having vast sums of money but about using money as a tool to lead a life filled with choices and lived on one’s own terms.

He emphasizes the importance of understanding and challenging our own beliefs about money, derived from our upbringing and societal pressures. Sethi critiques the standard advice of cutting back on small daily expenses like lattes and instead focuses on big wins, such as negotiating for a higher salary or optimizing large monthly expenses.

The 6-Week Program

Sethi introduces a 6-week program to achieve financial wellness. Each week is dedicated to a specific aspect of personal finance.

In the first week, he talks about setting up credit cards, learning about credit scores, and how to optimize for rewards. The second week is about setting up no-fee, high-interest bank accounts.

By the third week, you are introduced to opening a Roth IRA and 401(k). In the fourth week, he explains how to figure out how much you’re spending and introduces the concept of “conscious spending.”

The fifth week covers automated savings. The final week is about investing and learning the difference between stocks, bonds, and other investment vehicles.

Automating Finances

A cornerstone of Sethi’s philosophy is the idea of “setting and forgetting” your finances. Instead of constantly worrying about every penny, Sethi advises automating finances so that money flows where it needs to without regular intervention.

This includes automatic transfers to savings accounts, investments, and bills. By automating, one ensures that they’re saving and investing consistently without the pain of decision-making every time. It’s a behavioral trick that harnesses the power of inertia for financial gain.

Investing and Growth

Sethi demystifies the world of investing, stressing the importance of starting early due to the magic of compound interest.

He warns against trying to time the market or falling for the allure of “hot stocks.” Instead, he champions a long-term, passive investment strategy using low-cost, diversified index funds. He breaks down the nuances of asset allocation and underscores the significance of continued investments, especially during market downturns.

He also touches on the importance of negotiating salaries and raises, given that one’s earning potential is the biggest tool in the arsenal for amassing wealth.

Conscious Spending and Living Richly

Sethi’s approach to spending is refreshingly unconventional.

Rather than advocating for relentless frugality, he introduces the idea of “conscious spending” – spending exuberantly on the things you love while cutting costs mercilessly on things you don’t care about.

This is tied back to the concept of a “Rich Life,” which is personalized for every individual. Whether one’s passion is travel, dining out, or collecting rare items, Sethi’s philosophy permits and even encourages lavish spending, as long as it’s done consciously, joyfully, and without compromising long-term financial goals.

Also Read: The Sunflower Summary and Key Lessons | Simon Wiesenthal

Key Lessons

1. The Power of Automation

Principle: Sethi’s major emphasis is on the automation of finances. Automation eliminates the need for constant decision-making, reduces human error, ensures consistent investments, and prevents emotional spending or investing.

Implementation: To employ this, start by directing your paycheck into your checking account. From there, set up automatic transfers to:

- An emergency savings account (enough to cover 3-6 months of living expenses).

- Retirement accounts (like a 401(k) or Roth IRA).

- Other investment accounts.

- Regular bills (utilities, rent, mortgage).

Benefits: Over time, this automation ensures that you’re always paying yourself first. It harnesses the power of compound interest, guarantees you’re saving and investing regularly, and minimizes the chances of impulsive or emotional financial decisions.

2. Conscious Spending Over Frugality

Principle: Instead of agonizing over every small purchase or cutting out daily joys, Sethi champions the idea of spending consciously—allocating money towards what genuinely matters to you and cutting back aggressively on what doesn’t.

Implementation: Begin by categorizing your spending. Identify areas where you derive real joy and areas that don’t align with your priorities or long-term goals. Allocate more funds to the former and reduce or eliminate spending in the latter. For instance, if you’re passionate about travel but indifferent about dining out, budget generously for trips while minimizing restaurant expenses.

Benefits: This approach allows you to enjoy life and indulge in passions without guilt. It’s a sustainable strategy because it doesn’t feel restrictive. By focusing on big wins and making significant cuts in non-essential areas, you can enjoy your money while still working towards your financial goals.

Also Read: To Kill a Mockingbird Summary and Key Lessons

3. Long-Term, Passive Investing Strategy

Principle: Instead of chasing after the next big stock or trying to “beat the market,” Sethi suggests a more passive, long-term approach to investing, anchored in the principles of diversification and the power of compound interest.

Implementation: Start by understanding your risk tolerance and investment horizon. Based on that, choose an asset allocation of stocks and bonds that aligns with your risk profile. Invest in low-cost index funds, which track the broader market, rather than picking individual stocks. Regularly contribute to these investments, irrespective of market highs or lows, practicing what’s called dollar-cost averaging.

Benefits: Passive investing reduces the risks associated with stock picking and market timing. It’s a strategy based on the historical performance of the market, which has, over long periods, shown upward trends despite short-term volatility. Coupled with the magic of compound interest, where interest builds upon interest, this approach can lead to significant wealth accumulation over the long term.

Final Thoughts

“I Will Teach You to Be Rich” stands out for its actionable, no-nonsense approach tailored for younger audiences. While it demystifies complex financial topics, the book’s greatest strength lies in its emphasis on personal values and conscious choices.

Sethi’s message resonates: financial success isn’t just about the numbers; it’s about leading a life of intention and fulfillment.

Read our other summaries