The Millionaire Next Door | Summary and Key Lessons

“The Millionaire Next Door: The Surprising Secrets of America’s Wealthy” is a best-selling personal finance book written by Thomas J. Stanley and William D. Danko. Published in 1996, it presents the results of a comprehensive research study conducted by the authors, which aimed to analyze the common characteristics of millionaires in the United States.

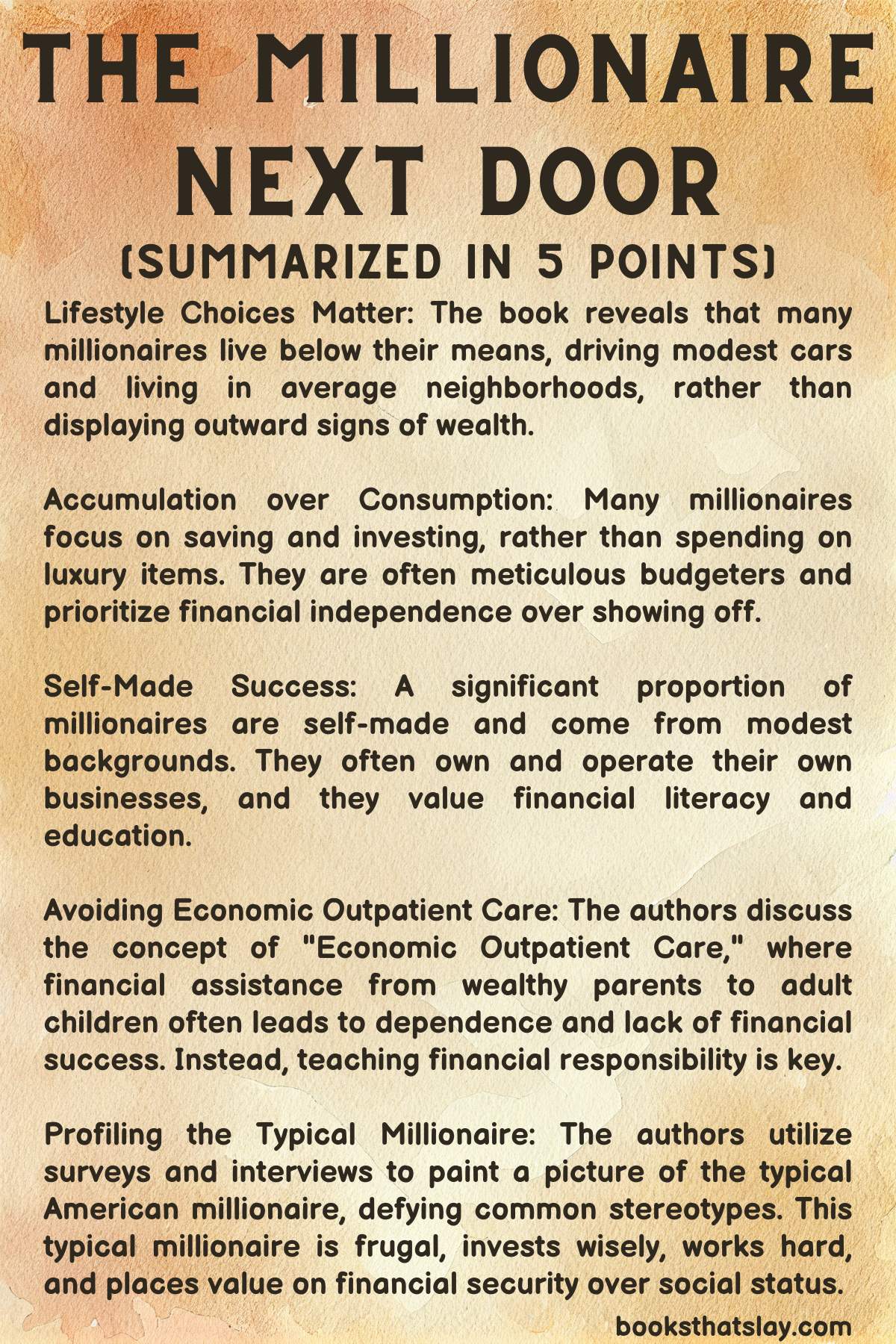

The Millionaire Next Door Summary

The key thesis of the book is that the majority of millionaires are not the flamboyant, high-spending individuals we often imagine, but rather are frugal, disciplined, and more often than not, live next door.

The authors found that a significant proportion of American millionaires live well below their means, investing the surplus wealth instead of spending it on luxury items or status symbols.

The book is divided into eight chapters, each one exploring a different aspect of wealth accumulation.

1. Meet the Millionaire Next Door

This introductory chapter discusses the common misconceptions about millionaires. The authors demonstrate that most millionaires don’t live in the most expensive neighborhoods or drive the priciest cars, but instead prefer to live frugally, save, and invest.

2. Frugal Frugal Frugal

The authors highlight the importance of frugality as a common trait among millionaires. They argue that being frugal allows people to accumulate wealth and maintain it. They discuss how millionaires often purchase used cars instead of new ones and prefer quality over brand names.

3. Time, Energy, and Money

This chapter focuses on how millionaires allocate their resources. They are often meticulous budgeters and planners, and place a high value on financial independence, investing a lot of their time and money in building their wealth.

4. You Aren’t What You Drive

The authors discuss the concept of “economic outpatient care” (EOC), where affluent parents provide substantial financial assistance to their adult children.

They argue that this can be counterproductive, creating a dependence on wealth instead of teaching children how to create it themselves. The chapter also underlines the finding that millionaires are more likely to buy modest, dependable vehicles rather than flashy, expensive ones.

5. Economic Outpatient Care

The authors delve deeper into the concept of EOC in this chapter. They show that children who receive less financial assistance from parents tend to accumulate more wealth as they learn to be more self-reliant and financially disciplined.

6. Affirmative Action, Family Style

This chapter emphasizes that wealthy parents often help their children by providing them with opportunities such as funding their education or helping them start a business. However, the authors caution that there’s a balance to be struck to avoid creating a sense of entitlement or dependency.

7. Find Your Niche

The authors suggest that self-employed individuals are four times more likely to be millionaires than those who work for others. They encourage readers to find a niche where they can excel and potentially start their own business.

8. Jobs: Millionaires versus Heirs

In the final chapter, the authors discuss the importance of choosing the right occupation. They argue that pursuing a career that one enjoys and is good at, is more likely to lead to wealth creation rather than simply choosing a career based on its potential to generate income.

Also Read: Dare to Lead | Summary + Key Lessons

Key Lessons

- Living Below One’s Means:

- Lesson Details: The book emphasizes that many millionaires tend to live well below their means, adopting a frugal lifestyle that enables them to save and invest a significant portion of their income.

- Examples: The authors cite numerous cases where individuals with high incomes chose to drive modest cars and live in unassuming homes, avoiding conspicuous consumption that might dilute their wealth.

- Implications: This principle instructs readers that accumulating wealth isn’t necessarily about earning more but spending wisely. By adopting a frugal lifestyle, one can save money, invest in future opportunities, and achieve financial independence.

- Lesson Details: The book emphasizes that many millionaires tend to live well below their means, adopting a frugal lifestyle that enables them to save and invest a significant portion of their income.

- Focus on Financial Independence over Displaying High Social Status:

- Lesson Details: The authors find that the truly wealthy often place a greater importance on financial independence and security rather than displaying their wealth through material possessions.

- Examples: One of the central findings of the book is that millionaires often own businesses in unglamorous industries (e.g., waste management, agriculture), concentrating on income-producing assets rather than status symbols.

- Implications: This lesson encourages readers to pursue goals that create lasting financial stability rather than chasing short-term social status. By concentrating on investments and businesses that generate income, one builds a foundation for long-term financial success.

- Lesson Details: The authors find that the truly wealthy often place a greater importance on financial independence and security rather than displaying their wealth through material possessions.

- The Importance of Financial Education and Self-Discipline:

- Lesson Details: Throughout the book, the authors stress the importance of educating oneself about personal finance, investment strategies, and the value of self-discipline in managing money.

- Examples: Several examples are given of individuals who, despite not having high-paying jobs, managed to accumulate substantial wealth through consistent saving, prudent investing, and avoiding debt.

- Implications: This lesson underscores that wealth accumulation is accessible to a wide range of people, not just high earners. By maintaining discipline in spending, understanding the basics of investment, and staying committed to long-term financial goals, financial success is achievable.

- Lesson Details: Throughout the book, the authors stress the importance of educating oneself about personal finance, investment strategies, and the value of self-discipline in managing money.

- Investing Time and Effort in Understanding and Growing Wealth:

- Lesson Details: The book emphasizes that wealth isn’t just about making money but understanding how to manage, grow, and preserve it. This requires an investment of time and effort in financial planning, budgeting, and understanding various investment avenues.

- Examples: The authors highlight individuals who dedicate time to budgeting, financial planning, and researching investment opportunities, rather than relying solely on professional advisors. These people often utilize self-education and continuous learning as tools to build and sustain wealth.

- Implications: This lesson teaches that passive reliance on others to manage one’s financial affairs can lead to missed opportunities or even financial loss. Actively engaging in one’s financial life, understanding where money is invested, and making informed decisions are key factors in not only accumulating wealth but preserving and growing it.

- Lesson Details: The book emphasizes that wealth isn’t just about making money but understanding how to manage, grow, and preserve it. This requires an investment of time and effort in financial planning, budgeting, and understanding various investment avenues.

The insights from this lesson extend beyond financial matters, emphasizing the broader themes of personal responsibility, continuous learning, and engagement in one’s own life and success. By embracing these principles, readers can apply them not only to their financial pursuits but also to other areas of life where similar principles might lead to success and fulfillment.

Final Thoughts

“The Millionaire Next Door” presents an image of the millionaire as an individual who values financial independence, frugality, and self-reliance over ostentatious displays of wealth.

It dispels the myth of the millionaire lifestyle often portrayed in media and offers actionable insights into how the average person can accumulate wealth by living below their means, being disciplined about saving and investing, and choosing a career that they enjoy and are good at.

The authors’ findings underscore the importance of financial literacy and discipline as key elements in wealth accumulation and retention.

Also Read: