Predictably Irrational Summary and Key Lessons

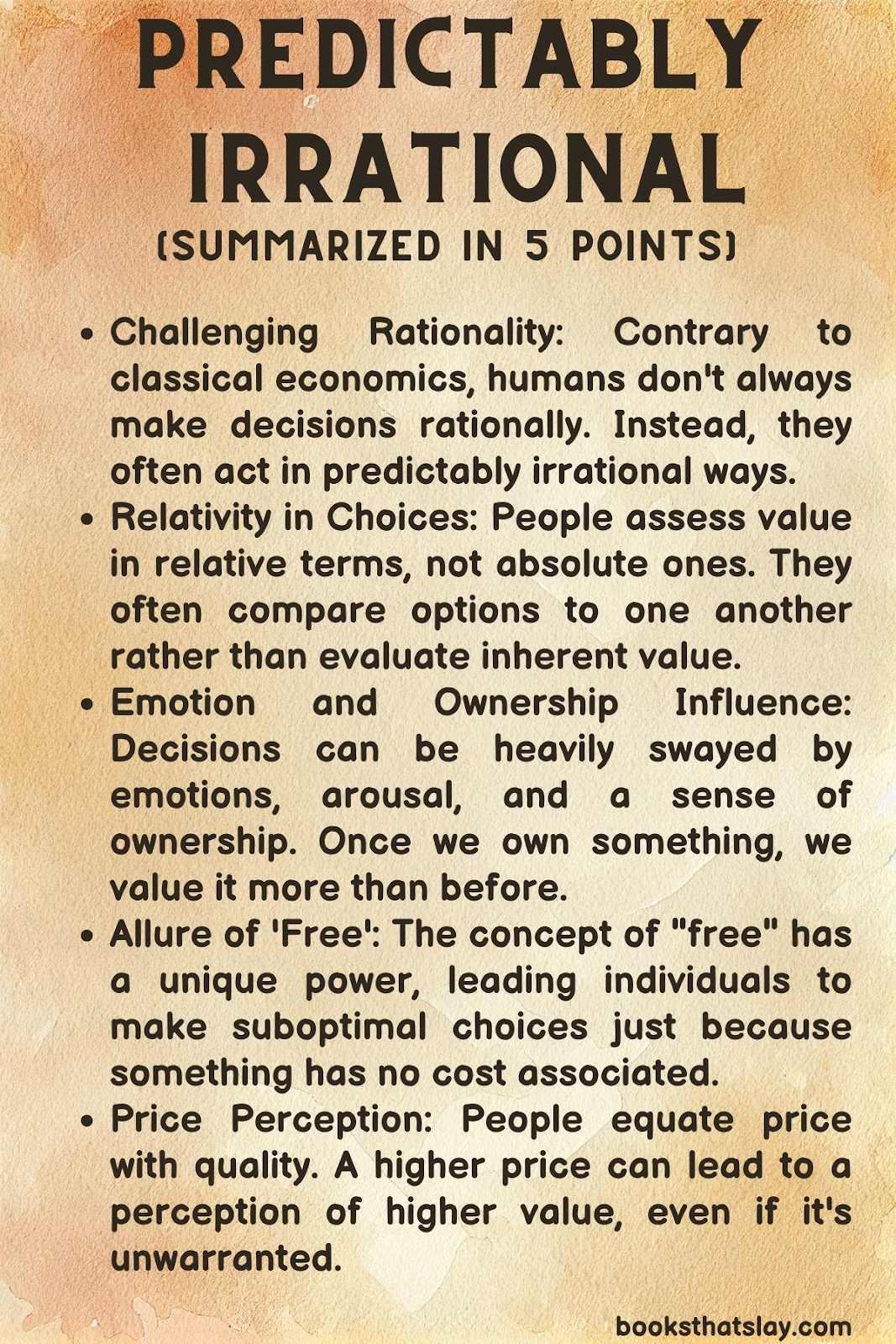

“Predictably Irrational” by Dan Ariely delves into the hidden forces that shape our decisions, demonstrating that humans are frequently not the rational actors that classical economic theory assumes.

Quick Summary: The book explores the consistent irrational behaviors humans display, challenging classical economics’ idea of rational decision-making. Through experiments, Ariely reveals how emotions, relativity, and societal norms often skew our choices, suggesting an understanding of these patterns can lead to better decisions.

Full Summary

Introduction to Behavioral Economics

The premise of “Predictably Irrational” challenges the traditional economics assumption that people always act rationally to maximize their benefits.

Instead, Ariely proposes that our behaviors are influenced by irrationality in consistent and predictable ways. Through a series of experiments and examples, the book unfolds the various dimensions of this irrationality.

Ariely, a professor of psychology and behavioral economics, has used his research findings to shine light on this topic, offering insights into why we often make seemingly illogical choices.

The Power of Relativity and the Problem of Procrastination

One of the initial concepts Ariely discusses is the power of relativity.

We don’t assess the value of things in absolute terms, but rather in relation to other things.

For instance, an item may seem expensive on its own, but cheap when compared to a higher-priced alternative. Another concept is the problem of procrastination and self-control. We may choose immediate pleasures (like eating unhealthy food) even if it’s at the expense of future benefits (like good health).

To demonstrate this, Ariely refers to experiments with students and deadlines, showcasing that given the chance, people often set binding constraints to limit their future choices and avoid procrastination.

The Influence of Arousal, Decoy Effect, and Ownership

Ariely delves into the impact of emotions and arousal on decision-making, suggesting that decisions made in the heat of the moment can significantly deviate from those made in a calm state.

The book also touches upon the decoy effect – where a third option can make one of the other two more attractive. A classic example is the subscription model of a magazine which presents a digital-only version, a print-only version, and a combo deal, where the print-only version serves as the decoy to make the combo seem more valuable.

Furthermore, the endowment effect is introduced: once we own something, we tend to overvalue it, and this can cloud our judgment about its true worth.

The Cost of Zero Cost and The Power of Price

The concept of “free” has a powerful allure. Ariely explains that people often overreact to the word “free”, leading them to make choices that aren’t necessarily in their best interest.

For example, we might opt for a free item over a much higher-value item that has a small cost.

Additionally, the way we perceive prices plays a role in our purchasing decisions.

Price can sometimes be seen as an indicator of quality, leading people to believe that a higher-priced item is of superior quality, even when it’s not.

The Broader Implications of Predictable Irrationality

Ariely concludes the book by discussing the broader implications of understanding our predictable irrationalities. Recognizing these behavioral patterns doesn’t just influence individual decisions, but also has vast ramifications for businesses, policy-making, and societal structures.

By being aware of these patterns, individuals and institutions can make better-informed decisions and craft more effective interventions.

In essence, while our irrational behaviors might be hardwired to an extent, understanding and anticipating them allows for better outcomes in various spheres of life.

Also Read: Games People Play Summary and Key Lessons

Key Lessons

The Bewitching Power of “Free”

Ever found yourself grabbing that extra “buy one, get one free” item at the store, even when you didn’t need it?

Or choosing a free, but less beneficial option over a slightly costlier, more advantageous one?

That’s because the allure of “free” can sometimes short-circuit our rational brains. Ariely shows that when confronted with the word “free,” we might neglect the real value of the choices at hand.

Lesson: The next time you see a “free” offer, take a moment to pause. Ask yourself: Would I still want this if it wasn’t free? Evaluating offers without the distracting allure of “free” can lead to more rational choices that align better with our needs.

Relativity is Our Mental Ruler

Imagine you’re out shopping for a $1,000 laptop, and then you see a $50 add-on accessory.

You might think, “It’s just 5% more, why not?” But would you travel across town to save $50 on a $100 purchase?

In the grand landscape of prices, how we perceive a deal’s worth is always relative to something else, often in ways that defy logic. Ariely’s exploration into the concept of relativity in decision-making reveals how we rarely choose things in absolute terms.

Lesson: Awareness of this can prevent buyer’s remorse. When making decisions, especially monetary ones, challenge yourself to consider the absolute value and not just the relative perceived savings or costs.

Also Read: The Tao Te Ching Summary and Key Lessons

Ownership Clouds Objectivity

Own a cherished old sweater you can’t part with?

Or find it hard to sell a possession for a price lower than what you believe it’s worth?

This might be due to the “endowment effect.” Ariely suggests that once we own something, we tend to see it through rose-tinted glasses, often overvaluing its worth.

Lesson: Recognize this emotional attachment when decluttering or selling possessions. Stepping back and trying to see things from an outsider’s perspective can lead to clearer, more rational decisions about what truly adds value to your life.

Final Thoughts

“Predictably Irrational” is a masterful exploration into the intricacies of human decision-making, revealing that our choices are not always rooted in the logical paradigms that classical economics suggests. Dan Ariely doesn’t just point out our irrational tendencies; he dives deep into understanding why these quirks of behavior exist, using rigorous experimental evidence to back his claims.

Read our other summaries