The Total Money Makeover Summary and Key Lessons

Embark on a transformative journey towards financial wellness with Dave Ramsey’s “The Total Money Makeover.” This insightful guide unfolds Ramsey’s time-tested strategies, empowering you to break free from debt, manage your finances wisely, and achieve lasting economic stability.

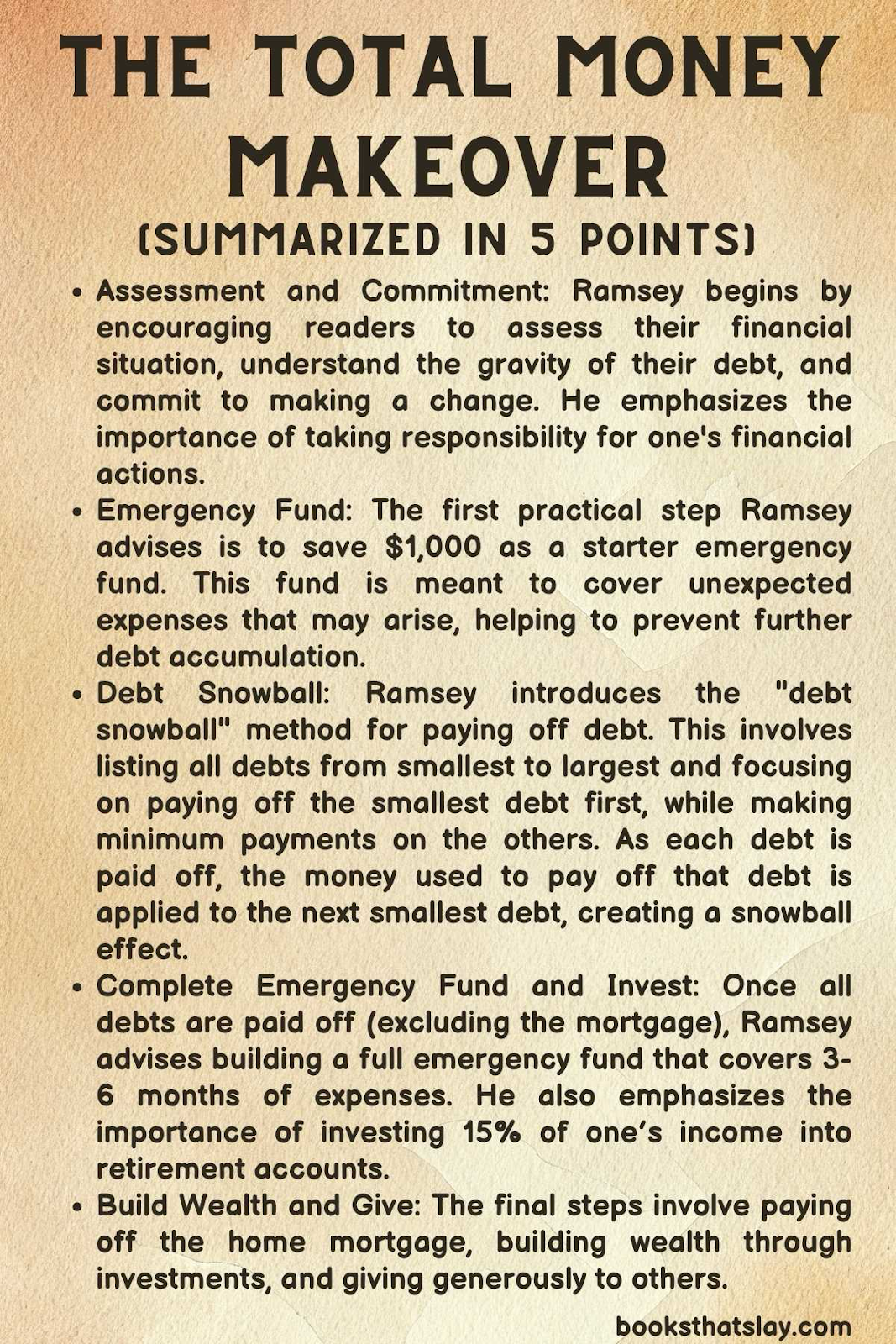

Quick Summary: Dave Ramsey presents a practical and straightforward plan for financial freedom, guiding readers through budgeting, eliminating debt, and building wealth. With real-life success stories, he inspires a disciplined approach to money, leading to a heightened sense of security and prosperity.

The Total Money Makeover Full Summary

Embracing a New Mindset

The book starts by challenging us to adopt a new mindset towards money and personal finance.

Ramsey emphasizes the importance of taking personal responsibility for one’s financial situation, regardless of income level. He criticizes common financial advice, such as the use of credit cards for rewards, and encourages us to live below our means.

The book stresses the importance of intentionality in spending, saving, and investing.

The Seven Baby Steps

The core of Ramsey’s strategy is encapsulated in the Seven Baby Steps. These are sequential steps designed to create a solid financial foundation, eliminate debt, and build wealth.

- Baby Step 1: Save $1,000 to start an emergency fund. This small fund serves as a cushion for unexpected expenses.

- Baby Step 2: Pay off all debt (except the house) using the Debt Snowball method. List debts from smallest to largest and focus on paying off the smallest debt first while making minimum payments on the rest. As each debt is paid off, apply the freed-up money to the next debt on the list.

- Baby Step 3: Save 3-6 months of living expenses in an emergency fund. This larger fund provides financial security in case of job loss or other major financial setbacks.

- Baby Step 4: Invest 15% of household income into retirement accounts.

- Baby Step 5: Save for children’s college education using tax-advantaged savings accounts.

- Baby Step 6: Pay off home early.

- Baby Step 7: Build wealth and give generously.

The Debt Snowball Method

One of the most famous aspects of Ramsey’s plan is the debt snowball method. This involves listing all debts from smallest to largest, regardless of interest rate, and focusing on paying off the smallest debt first while making minimum payments on the rest.

Once the smallest debt is paid off, the payment amount is rolled over to the next smallest debt. This creates a “snowball” effect, as payments get larger and debts are paid off more quickly over time.

Ramsey argues that the psychological wins of paying off smaller debts first provide motivation to tackle larger debts.

Budgeting and Saving

Ramsey places a strong emphasis on budgeting as a foundational practice for financial success. He advocates for the use of a zero-based budget, where every dollar is assigned a specific purpose before the month begins.

This helps to ensure that spending aligns with priorities, and it helps to prevent wasteful spending. Additionally, the book discusses the importance of saving for emergencies, as well as for specific goals like purchasing a car or a home.

Building Wealth and Giving

The final stages of the Total Money Makeover involve building wealth through investing and real estate, as well as the importance of giving generously.

Ramsey provides guidance on retirement investing, emphasizing the value of mutual funds and advising against speculative investments. He also discusses the potential benefits of purchasing a home and paying off the mortgage early. Throughout, he emphasizes the importance of generosity, arguing that building wealth provides the opportunity to make a positive impact on others.

Also Read: The Science Of Getting Rich Summary and Key Lessons

Key Lessons

1. The Power of Behavior Change and Personal Responsibility

One of the overarching themes of the book is the importance of taking personal responsibility for one’s financial situation.

Ramsey emphasizes that financial success is less about the specific financial tools one uses, and more about one’s behavior and mindset. He encourages us to stop looking for quick fixes or blaming external circumstances, and instead focus on changing their habits and attitudes towards money.

- Practical Application: This might involve cutting up credit cards, creating a written budget for the first time, or getting a second job to increase income. Ramsey encourages us to take an active role in their financial recovery, which includes making sacrifices and establishing discipline.

- Long-Term Impact: By adopting a proactive and responsible mindset, individuals set themselves up for long-term financial success. This mindset shift can lead to a life free from debt, with a solid financial foundation, and the ability to build wealth and give generously to others.

2. The Importance of Living Debt-Free

Ramsey is a strong advocate for living a debt-free life.

He asserts that debt is a significant barrier to financial freedom, and he provides a systematic method for eliminating it. He argues that debt magnifies financial stress and limits one’s options, making it harder to build wealth over the long term.

- Practical Application: To apply this lesson, we are encouraged to list all their debts and start paying them off using the debt snowball method, which involves focusing on the smallest debt first and then moving to the next smallest. This method provides quick wins and builds momentum.

- Long-Term Impact: Living debt-free reduces financial stress, frees up income for saving and investing, and provides a sense of freedom and control over one’s financial life. It also enables individuals to make choices based on their values and priorities, rather than being dictated by debt payments.

Also Read: The Road to Character Summary and Key Lessons

3. The Necessity of Budgeting and Planning

A central component of Ramsey’s plan is the establishment of a zero-based budget, which requires giving every dollar a job and planning for every expense before the month begins.

He highlights that budgeting is not about restriction, but about creating a plan to ensure that money is being used in ways that align with one’s goals and values.

- Practical Application: You can implement this lesson by creating a monthly budget, tracking their spending, and adjusting their budget as needed. This practice helps to prevent overspending, ensures that essential expenses are covered, and enables saving for future goals.

- Long-Term Impact: Establishing and sticking to a budget helps to build discipline, ensures financial stability, and contributes to long-term wealth building. It enables individuals to proactively manage their money, rather than wondering where it went at the end of the month.

Final Thoughts

“The Total Money Makeover” offers a straightforward and practical approach to managing personal finances. Dave Ramsey’s steps are easy to understand and follow, making it accessible to a wide audience.

While some critics argue that the methods are too rigid or simplistic, many readers have found success and financial freedom through following Ramsey’s plan.

The book emphasizes the importance of personal responsibility, disciplined saving, and living within one’s means, which are valuable lessons for anyone looking to improve their financial situation.

Read our other summaries