Die With Zero Summary and Key Lessons

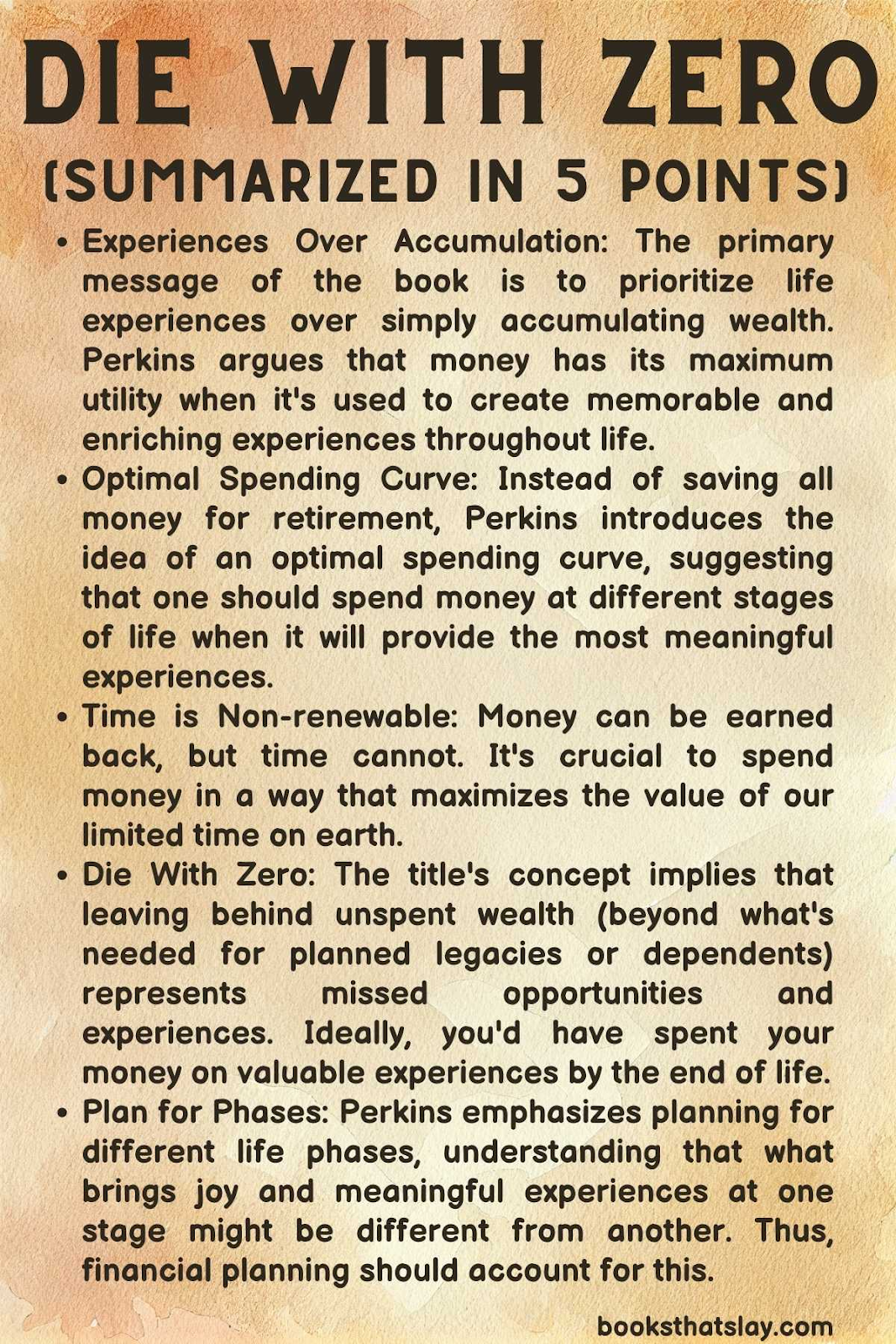

“Die With Zero” by Bill Perkins challenges conventional financial wisdom, urging readers to optimize their wealth for life’s experiences rather than merely accumulating it. It’s a call to live fully, embrace timely generosity, and ensure that by life’s end, there are no regrets about missed opportunities.

Quick Summary: Bill Perkins’ “Die With Zero” emphasizes spending wealth on life experiences at optimal times. Advocating for timely generosity and active living, Perkins contends that money should fuel memories and impact, rather than simply amass, ensuring a life lived to the fullest without regrets at its conclusion.

Die With Zero Full Summary

Perkins challenges conventional wisdom that emphasizes saving endlessly for a future retirement, often at the expense of present-day experiences and enjoyment.

He argues that money serves as a tool for experiencing life to the fullest, and we should aim to use our resources in a way that aligns with our life’s various phases, ensuring we derive maximum enjoyment, meaning, and fulfillment.

The title, “Die With Zero”, suggests the ultimate goal: to optimize one’s financial resources in such a way that, by the end of one’s life, you’ve extracted the maximum value from them in terms of experiences and impact, rather than hoarding them unnecessarily.

Experiential Value Over Time

Perkins introduces the concept that suggests that the value of experiences changes as we age.

For instance, the experience of backpacking through Europe might be immensely valuable and transformative for someone in their 20s, but far less feasible or appealing for someone in their 70s.

Money should be allocated to provide these experiences at the appropriate times, rather than perpetually deferred for a future that may never come or may come when one is less able to enjoy certain experiences.

Legacy and Impact

While the book emphasizes maximizing personal experiences, it doesn’t advocate for selfishness.

Perkins recognizes the importance of providing for one’s family and leaving a legacy. However, he challenges readers to think about the timing and manner of their giving.

For example, helping a child with a down payment on a house when they are starting a family may be more impactful than leaving them a large inheritance when they are middle-aged and established.

This immediate giving can yield more “experiential dividends” and let the giver witness the benefits of their generosity.

Planning for Maximum Utility

To “Die With Zero”, careful financial planning is crucial.

Perkins doesn’t advocate for reckless spending, but rather an intentional approach that considers the value of experiences throughout one’s life. This might involve front-loading certain experiences earlier in life and understanding that future dollars—due to health, age, or life circumstances—might not yield as much happiness or value.

He also touches on tools like annuities that can provide a steady stream of income in later years, ensuring comfort and security while still maximizing life’s experiences.

Counterarguments and Reflection

Perkins acknowledges that his philosophy might not resonate with everyone. Some individuals derive immense satisfaction from accumulating wealth as a scorecard or want to leave substantial legacies for charitable causes.

Others have deep-seated fears about potential future financial hardships.

While recognizing these perspectives, “Die With Zero” serves as a call to reflection –

Are individuals living in line with their true values and desires, or are they following financial scripts that might lead to regret and missed opportunities?

Also Read: Steal Like an Artist Summary And Key Lessons

Key Lessons

- Optimize Life’s Experiences Over Lifelong Accumulation:

- Rationale: The cultural norm often promotes saving endlessly for an uncertain future, potentially leading to a life where some of the best experiences are missed or delayed until they’re no longer feasible. By viewing money as a means to an end—namely, the experiences and memories one can create—it becomes clear that perpetual accumulation without purpose might lead to regrets.

- Actionable Steps:

- Personal Audit: Periodically assess your bucket list or life goals and compare them with your current financial strategy. Are you on track to experience these events or milestones at the optimal times in your life?

- Prioritize Spending on Experiences: Allocate a portion of your budget for experiences, adventures, or learning opportunities that align with your current life phase.

- Avoid Deferred Living: If you constantly tell yourself “I’ll do it someday,” challenge this thinking. Consider the feasibility of the experience as you age and whether the perceived future value truly outweighs the present opportunity.

- Rationale: The cultural norm often promotes saving endlessly for an uncertain future, potentially leading to a life where some of the best experiences are missed or delayed until they’re no longer feasible. By viewing money as a means to an end—namely, the experiences and memories one can create—it becomes clear that perpetual accumulation without purpose might lead to regrets.

- Time Your Generosity for Maximum Impact:

- Rationale: Traditional estate planning often focuses on leaving wealth behind after death. However, by providing support or sharing wealth when it can make a transformative difference in the lives of loved ones, not only do you optimize the impact of your gift, but you also get the joy of witnessing its benefits.

- Actionable Steps:

- Open Conversations: Talk with family members or potential beneficiaries about their current needs, aspirations, and challenges. Such dialogues can illuminate opportunities for timely assistance.

- Strategic Gifting: Instead of waiting to leave lump sums, consider strategies like funding a grandchild’s education, assisting with a down payment on a home, or even investing in a loved one’s entrepreneurial venture.

- Incorporate Charitable Giving: If you’re inclined towards philanthropy, consider becoming actively involved or donating during your lifetime. This allows you to see the tangible impact of your contributions and adjust your giving strategy based on real-world outcomes.

- Rationale: Traditional estate planning often focuses on leaving wealth behind after death. However, by providing support or sharing wealth when it can make a transformative difference in the lives of loved ones, not only do you optimize the impact of your gift, but you also get the joy of witnessing its benefits.

Also Read: Bird by Bird Summary and Key Lessons

- Design Financial Strategies with a Time-Phased Approach:

- Rationale: As life progresses, the types of experiences that offer the most value or satisfaction may change. An adaptive financial strategy can help ensure you have the resources to make the most of each life phase.

- Actionable Steps:

- Dynamic Budgeting: Instead of a static budget, design a dynamic one that adjusts as you transition through life phases (e.g., adventurous travel in your youth, family-oriented experiences in middle age, and comfort-focused allocations in later years).

- Financial Tools for Later Life: Investigate financial instruments like annuities, which can guarantee income in retirement. This security can enable earlier life-phase spending without jeopardizing future comfort.

- Regular Reviews: Given the unpredictable nature of life, it’s crucial to review and adapt your financial strategy regularly. This ensures it aligns with both your current desires and the ever-evolving landscape of potential experiences.

- Rationale: As life progresses, the types of experiences that offer the most value or satisfaction may change. An adaptive financial strategy can help ensure you have the resources to make the most of each life phase.

Final Thoughts

In essence, “Die With Zero” encourages readers to see money as a tool for life enrichment, urging them to make intentional choices to ensure they don’t reach life’s end with regrets about missed experiences or delayed generosity.

Read our other summaries