Rich Dad Poor Dad Summary

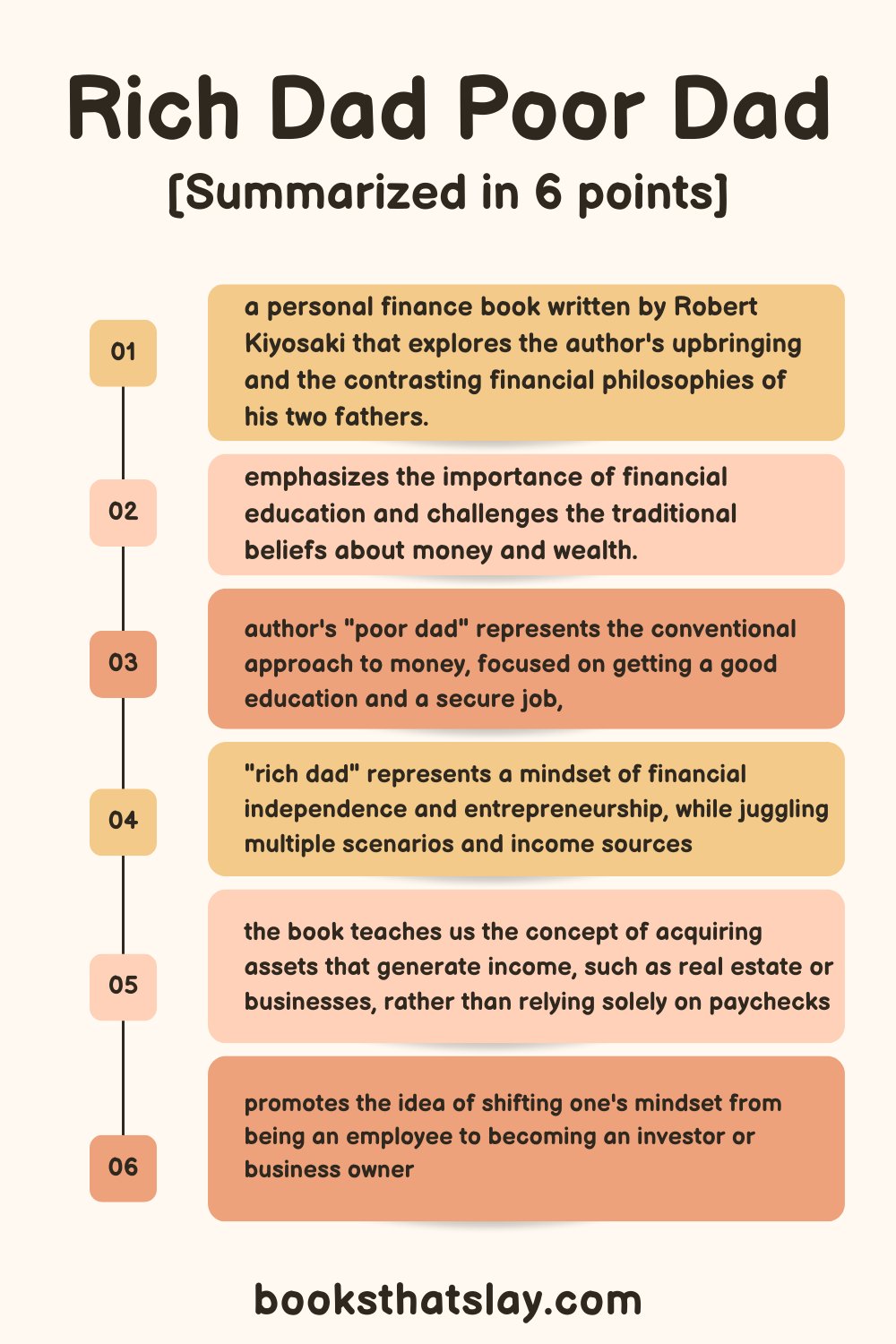

“Rich Dad Poor Dad,” written by Robert T. Kiyosaki, is a personal finance book that explores the differences in mindset and financial strategies between two father figures in the author’s life: his biological father (the “Poor Dad”) and the father of his best friend (the “Rich Dad”).

The “Poor Dad,” a highly educated man, represents the traditional approach to money—emphasizing formal education, job security, and working for a steady paycheck. In contrast, the “Rich Dad,” who lacks formal education but is financially successful, advocates for financial education, entrepreneurship, investing, and making money work for you.

The book’s core message is that financial literacy and understanding how money works are crucial to achieving financial independence. Kiyosaki challenges the conventional belief that higher education and a stable job are the keys to financial success.

Instead, he emphasizes the importance of acquiring assets, minimizing liabilities, and taking control of one’s financial future through investing in real estate, stocks, and businesses.

Rich Dad Poor Dad Summary

The book’s overarching theme is that the poor and middle class work for money, while the rich have money work for them. It conveys this message through the juxtaposition of two characters: Kiyosaki’s real father (“Poor Dad”) and his friend’s father (“Rich Dad”). The two characters embody contrasting views about money and wealth.

“Poor Dad” is Kiyosaki’s biological father, a man with excellent educational credentials, who held a stable job in the government sector, but never achieved financial security. He personifies the traditional route to success: go to school, get good grades, find a safe job, and save money.

In contrast, “Rich Dad,” Kiyosaki’s friend’s father, is an entrepreneur who owns a chain of convenience stores. He didn’t have much formal education, but understood the value of financial literacy and investing. He represents a non-conventional approach towards money and wealth.

Kiyosaki attributes his financial success to the lessons he learned from “Rich Dad,” which differed greatly from his “Poor Dad’s” teachings. The book outlines six key lessons that the author learned from his “Rich Dad”:

- The rich don’t work for money: The rich understand how to make money work for them by investing in income-generating assets.

- The importance of financial education: Understanding financial terms and having financial literacy is crucial in making informed financial decisions.

- Minding your own business: Focus on acquiring assets, like real estate, businesses, stocks, and bonds, rather than solely seeking promotions at your day job.

- Taxes and corporations: Rich people use corporations to their advantage to protect and increase their wealth, often paying less in taxes.

- The rich invent money: This emphasizes the ability to see opportunities where others see obstacles and to take calculated risks to seize these opportunities.

- The need to work to learn, not to earn: This underscores the importance of lifelong learning and acquiring various skills.

Throughout the book, Kiyosaki emphasizes that financial success is within everyone’s reach, provided they arm themselves with financial knowledge and the right mindset.

He stresses that one of the key components of becoming rich is understanding the difference between assets and liabilities. Assets, as Kiyosaki defines them, are things that put money in your pocket, while liabilities take money out.

Key Lessons

The Importance of Financial Literacy

Robert Kiyosaki emphasizes that one of the main reasons people struggle financially is because they spend years in school but learn nothing about money.

The “Rich Dad” instilled in him the understanding of how money works, such as knowing the difference between assets and liabilities.

Assets are things that put money into your pocket (like investments and real estate), while liabilities are things that take money out of your pocket (like a car loan or a mortgage).

Most people, including the “Poor Dad,” confuse liabilities with assets, leading to financial hardships.

For instance, buying a luxury car on loan may seem like a status symbol, but it’s a liability that drains your wealth over time.

In contrast, investing the same money in income-generating assets like stocks, bonds, or real estate could have multiplied it.

The Difference Between Working for Money and Making Money Work for You

Kiyosaki’s “Rich Dad” believed in the philosophy of earning passive income.

Instead of trading your time for money (as a regular job requires), you should focus on creating and buying assets that generate income. This principle is demonstrated through the story of young Kiyosaki and his friend working in a grocery store for a meager wage.

Realizing that this is akin to lifelong servitude, they instead opt to “make money work for them” by investing in a comic book library that generates regular income.

Understanding the Power of Corporations

Kiyosaki illuminates the idea of using corporations as a legal way to protect wealth and reduce tax liability.

It demonstrates the difference between how an employee and a corporation are taxed.

For employees, income is taxed, and they spend what is left, whereas corporations spend money first and are taxed on any income left.

This results in corporations and their owners keeping a larger share of their earnings, which can then be reinvested to grow their wealth further.

For instance, taking the example of a self-employed individual, by forming a corporation, they can classify their personal expenses as business expenses (e.g., cars, travel, meals) and reduce their taxable income.

Mind Your Own Business

This lesson underscores the importance of focusing on your own business.

Kiyosaki states that many people spend so much time working for someone else or worrying about their jobs that they ignore their own financial affairs.

This doesn’t mean you should quit your day job, but rather, you should concentrate on building and maintaining your asset portfolio. Your job can provide the capital needed to develop this.

For example, instead of spending surplus income on non-essential items, you could use it to acquire stocks or properties that could yield more income over time.

Overcoming Fear and Analysis Paralysis

Fear and doubt often hinder people from investing or taking financial risks.

The “Poor Dad” is plagued by the fear of unpaid bills, whereas the “Rich Dad” understood that fear and self-doubt could be overcome through knowledge and experience.

This lesson advocates for financial education as the antidote to fear. For instance, many people avoid investing in stocks because they’re afraid of the risks involved.

However, with adequate financial education and risk management skills, they can make informed decisions and potentially reap significant benefits.

Final Thoughts

You should read “Rich Dad Poor Dad” by Robert Kiyosaki because it offers you a unique perspective on personal finance and wealth creation. This book challenges conventional wisdom surrounding money and provides valuable insights into the mindset and strategies of the rich.

Through Kiyosaki’s storytelling and real-life examples, you will gain a deeper understanding of the importance of financial literacy, the difference between assets and liabilities, and how to make smart investment decisions.

Read our other summaries