The Black Swan | Summary and Key Lessons

“The Black Swan: The Impact of the Highly Improbable” is a groundbreaking book written by Nassim Nicholas Taleb, a former Wall Street trader, philosopher, and statistician. It was published in 2007 and focuses on extreme and unpredictable events, which Taleb calls “Black Swans.”

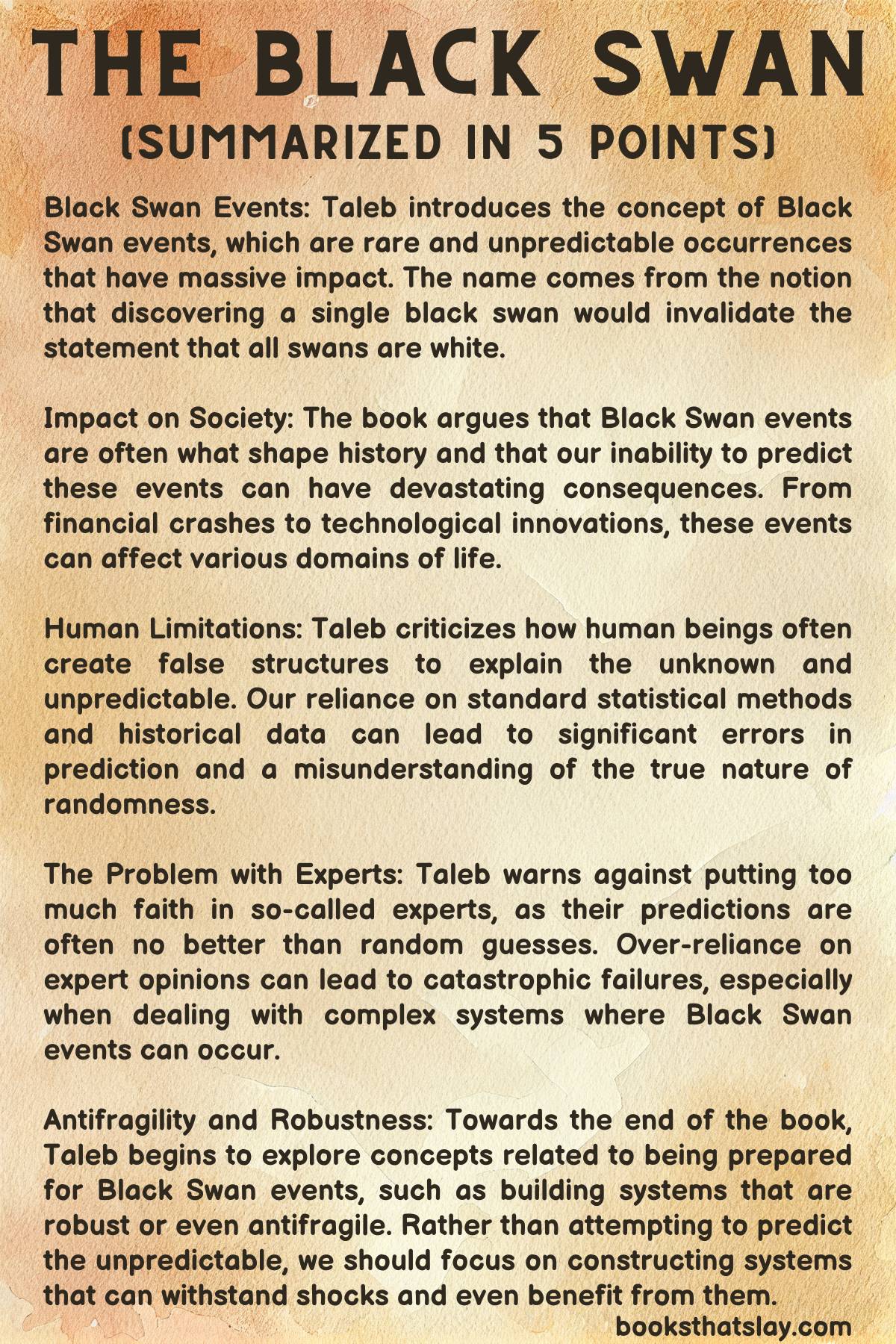

The book revolves around three central ideas: the disproportionate role of high-profile, hard-to-predict, and rare events in history, the non-computability of the probability of these outliers in terms of their impact and the psychological biases that blind people both individually and collectively to uncertainty and to a rare event’s massive role in historical affairs.

The Black Swan Summary

Taleb begins with the literal notion of a black swan, which comes from the ancient Western conception that ‘all swans are white.’

However, the discovery of black swans in Australia disproved this ‘known’ fact. Therefore, a Black Swan event is something that deviates beyond what is normally expected of a situation and is extremely difficult to predict.

These events have three attributes: rarity, extreme impact, and retrospective predictability.

Taleb divides the world into two realms: Mediocristan and Extremistan.

Mediocristan represents systems where the bell curve can predict events and outliers don’t carry massive impacts.

For example, if you randomly select a person from the population and measure their weight, it won’t significantly impact the average weight of the whole population.

On the contrary, Extremistan is a place where Black Swan events can dramatically affect outcomes, like in financial markets or book sales, where one blockbuster hit can outsell thousands of other books.

Taleb criticizes the traditional methods of probability calculation and risk assessment, particularly as they relate to financial markets.

He argues that people often make the mistake of using Gaussian distribution (normal distribution) to predict these events, whereas such events don’t follow a regular pattern or any known distribution.

Therefore, people underestimate the risk and impact of such events.

He also discusses the human mind’s limitations and biases, which make it difficult for us to understand randomness, probability, and uncertainty.

For instance, the narrative fallacy refers to our tendency to turn complex realities into oversimplified stories. Another concept, the ludic fallacy, explains how we wrongly believe that the structured randomness found in games resembles the unstructured randomness we find in life.

Throughout the book, Taleb emphasizes that we should not attempt to predict Black Swan events; rather, we should adjust to their existence and increase our robustness to negative ones while exploiting the positive ones.

Instead of trying to predict the improbable, we should focus on making ourselves less vulnerable to harm.

Also Read: Thank You for Arguing | Summary + Key Lessons

What can you learn from the book?

1. Embrace Uncertainty and Non-predictability

Taleb states that uncertainty is an inherent part of life, and that the real world is more random and unpredictable than we often think.

These can range from financial crashes, wars, and technological breakthroughs, to natural disasters, and they have a disproportionate effect on history, science, finance, and technology.

Taleb, for instance, uses the example of the September 11 attacks, a quintessential Black Swan event that profoundly changed the world.

No one predicted such an event, and the aftermath was even less predictable. Yet, in hindsight, it was often rationalized with explanations about intelligence failure, and geopolitical tensions.

This illustrates our human tendency to seek patterns and create narratives to make sense of the world around us, which can blind us to the inherent unpredictability of life.

2. Rethink Standard Models and Metrics

Taleb takes issue with our reliance on Gaussian or bell-curve distributions in numerous areas, including finance, risk management, and social sciences.

The Gaussian distribution, with its thin tails, fails to account for extreme events, making it ill-suited for predicting Black Swans. Instead, he proposes the use of “fat-tailed” distributions that better accommodate outliers.

For instance, in financial markets, risk models based on bell-curves (like the Value at Risk model) are widely used, leading to an underestimation of risk.

The 2008 financial crisis, which could be seen as a Black Swan, revealed the catastrophic implications of underestimating the probability of extreme events.

This highlights the need for models and metrics that account for the complex, non-linear nature of many phenomena in our world, to help us better manage risk and uncertainty.

Also Read: Radical Candor | Summary and Key Lessons

3. Build Robustness and Resilience

Taleb focuses on the importance of developing systems that are resilient to shocks and can withstand Black Swan events.

Rather than trying to predict these highly improbable events, we should focus on building robustness to negative ones and being open to positive ones. Taleb introduces the concept of “antifragility,” which goes beyond mere resilience or robustness.

Antifragile systems actually benefit from shocks, volatility, and uncertainty.

A practical example of this is in portfolio management.

Instead of trying to predict market movements, which is extremely difficult, one should build a diversified portfolio that can withstand market downturns and possibly even benefit from them.

This could involve including assets that do well during crises or volatile times (like gold or certain types of bonds) and not being overly exposed to any single asset or market.

This approach encapsulates Taleb’s idea of ‘antifragility’, preparing for various outcomes and embracing uncertainty.

4. Beware the Narrative Fallacy and Retrospective Distortion

Taleb cautions us about the narrative fallacy – our propensity to turn complex realities into overly simplistic stories.

This distorts our understanding of the world, leading us to overlook randomness and uncertainty. We often construct narratives that rely on causality, where events are linked in a coherent and predictable way.

This simplification allows us to comprehend the world, but it can also blind us to its inherent complexity and randomness.

A good example of this is the way we interpret historical events.

In retrospect, we tend to see past events as predictable or inevitable, weaving a narrative that links these events together in a meaningful pattern. This ‘retrospective distortion‘ can give us an illusion of understanding and predictability.

In the context of Black Swan events, the narrative fallacy leads us to overestimate the predictability of these events.

After a Black Swan event occurs, we create a narrative that makes it appear as if the event was predictable, despite the fact that it was not. This false sense of predictability can lead to overconfidence in our ability to predict future Black Swan events, leaving us unprepared when they occur.

To counter this, Taleb suggests that we should accept the randomness and unpredictability of these events, focus on potential consequences rather than on the probability of occurrence, and invest in preparedness rather than prediction.

Final Thoughts

In summary, “The Black Swan” challenges the reader to rethink their assumptions about the world and acknowledge the role of randomness, uncertainty, and probability in shaping events. Taleb encourages readers to embrace randomness and accept that our understanding of the world is limited and often flawed.

Also Read: