The Millionaire Fastlane | Book Summary

“The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime” is a book by MJ DeMarco that challenges conventional wisdom about wealth and retirement. DeMarco argues that traditional strategies, such as saving for retirement in a 401k, are not the fastest or most reliable paths to wealth.

He contends that we should not spend the majority of our lives working only to retire when we’re too old to enjoy the fruits of our labor.

The Millionaire Fastlane Book Summary

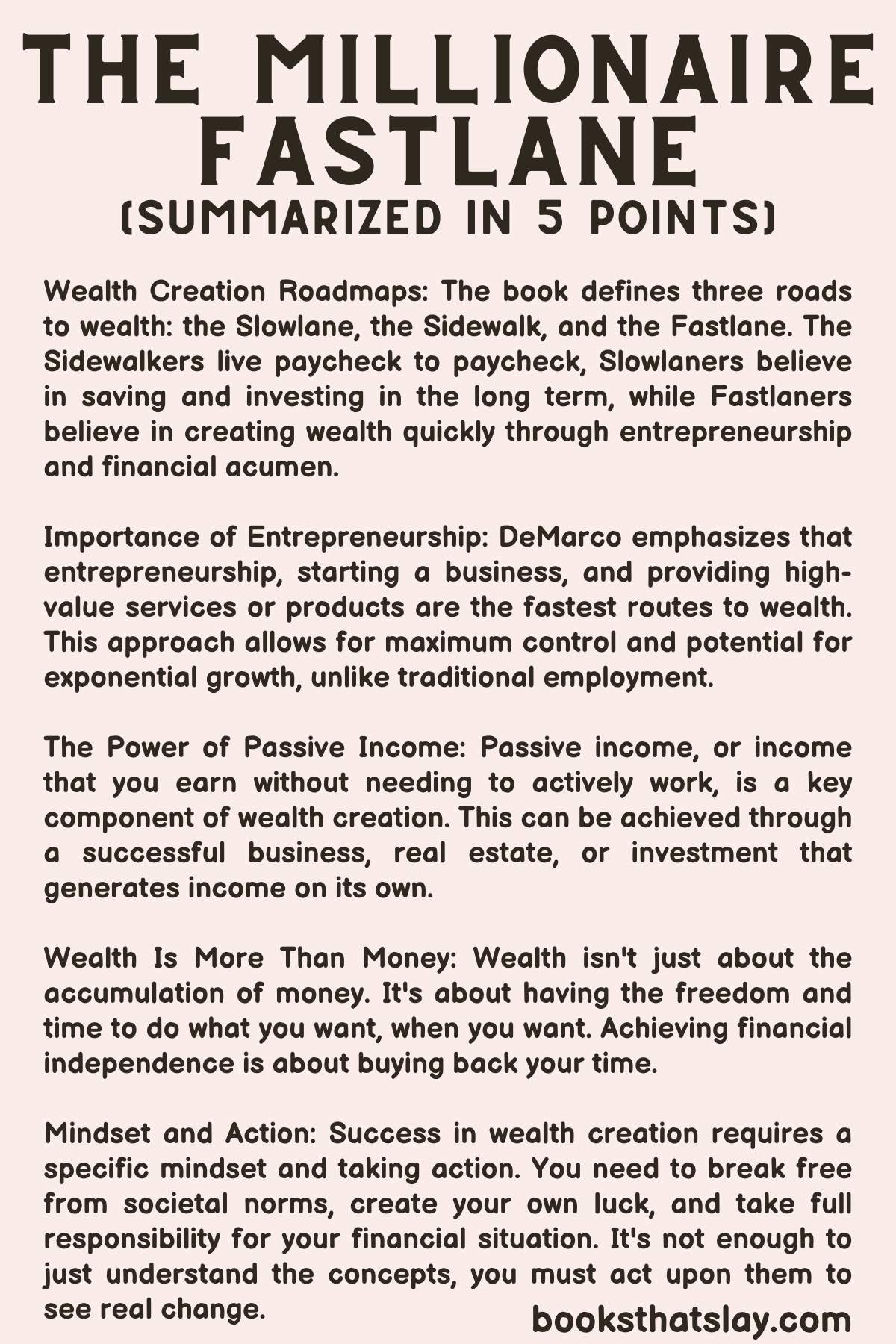

DeMarco’s main argument in “The Millionaire Fastlane” is that the ‘slowlane’ to wealth (i.e., conventional jobs and traditional investments) and the ‘sidewalk’ (i.e., living paycheck to paycheck) are not effective ways to amass wealth.

Instead, he proposes the ‘fastlane’ as the optimal approach to becoming a millionaire quickly.

Sidewalkers are those who are stuck in a cycle of spending without saving or investing. They often live paycheck to paycheck, use credit extensively, and are burdened by debt. They lack financial plans and typically chase the next big thing to satisfy their immediate gratification without considering the long-term implications.

Slowlaners, on the other hand, follow the widely accepted financial advice of getting a good job, saving, investing in a diverse portfolio, and retiring comfortably at the age of 65 or later. However, DeMarco argues that this path often leads to wealth in the late stages of life, making it difficult to fully enjoy the benefits.

In contrast, Fastlaners are those who recognize the limitations of traditional routes and choose to create their own paths. They prioritize creating scalable and profitable systems or businesses that allow them to generate passive income, thus accelerating their wealth creation. This group is not just about getting rich quick. They understand the importance of providing value, learning continuously, and taking calculated risks.

Key principles of the Fastlane approach include:

- Control: DeMarco emphasizes the need for entrepreneurs to maintain control over their businesses, as opposed to relying on unpredictable factors like the stock market or real estate prices.

- Scale and Magnitude: The author believes that for a business to make you wealthy quickly, it must have the capacity to scale and reach a large number of people (scale), and it must have a significant impact on those it reaches (magnitude).

- Time: Fastlaners understand that time is a precious and limited resource. They strive to detach their time from their income by creating passive income streams. This detachment is crucial for creating wealth and maintaining a desirable lifestyle.

- Need: A successful fastlane business is built on providing value or meeting a need in the market. The more urgent or widespread the need, and the more effectively the business meets it, the more potential there is for rapid wealth creation.

- Process: Fastlaners understand that wealth is not an event, but a process. While it may happen faster than in the slow lane, it still requires dedication, hard work, and patience.

Also Read: A Brief History of Time Summary

What can you learn from the book?

1. The importance of controlling your income source

DeMarco makes it clear that the conventional approach to wealth creation, such as earning a high salary or saving a portion of your income, is unlikely to make you rich quickly.

For example, a job or a career may pay well, but it limits your income potential because it’s typically controlled by someone else (your employer), and it’s directly tied to your time. The key takeaway here is to strive for a business or investment where you can control the income source and its potential. This control allows you to scale your income significantly, beyond the constraints of a 9-to-5 job.

An example of this can be the creation of a successful startup.

Here, the income isn’t fixed but depends on the growth of the business, which if successful, could significantly surpass the salary you could earn from conventional employment.

2. The power of compound interest, timing and scale

DeMarco reiterates the impact of compound interest, but with a unique twist.

He explains that time, not just money, needs to be compounded to achieve financial success. But most importantly, it is the scale and magnitude that can accelerate the process of becoming wealthy.

In other words, you need to have a business or investment model that can impact a large number of people, thereby significantly multiplying your earnings.

For example, if you create a mobile app that becomes popular, it could potentially be downloaded by millions of users worldwide. Even if you charge a small amount for each download, the scale of the user base can lead to substantial income.

Also Read: Salt Sugar Fat Book Summary

3. The significance of providing value

According to DeMarco, wealth creation isn’t just about finding a way to make money. It’s about providing real value to your customers or clients.

In essence, you need to solve a problem or fill a need that people are willing to pay for. The more significant the problem or need, the more people are willing to pay, thus increasing your income potential.

For example, consider the creation of Airbnb.

The founders identified a need (affordable accommodation for travelers) and provided a solution (connecting travelers with people willing to rent out their homes).

This value proposition led to the company’s massive success.

4. Understanding the concept of Fastlane and Slowlane

DeMarco introduces two concepts in his book – the Fastlane and the Slowlane (already discussed above)

The key lesson here is to understand the potential and risks associated with both paths, and choose the one that aligns with your life goals and risk tolerance. DeMarco isn’t against the Slowlane, but he argues that if your goal is to become wealthy while you’re still young enough to enjoy it, you’ll need to take the Fastlane.

Final Thoughts

In conclusion, “The Millionaire Fastlane” provides a contrarian view on wealth creation, challenging traditional methods of saving and investing. DeMarco pushes readers to take control of their financial destiny by becoming entrepreneurs and innovators, offering a potentially faster, though still demanding, route to wealth.

Also Read: