The Simple Path To Wealth Summary and Key Lessons

“The Simple Path to Wealth” by JL Collins is a book in the field of personal finance and investment, that provides straightforward advice on building wealth in a smart and sophisticated manner.

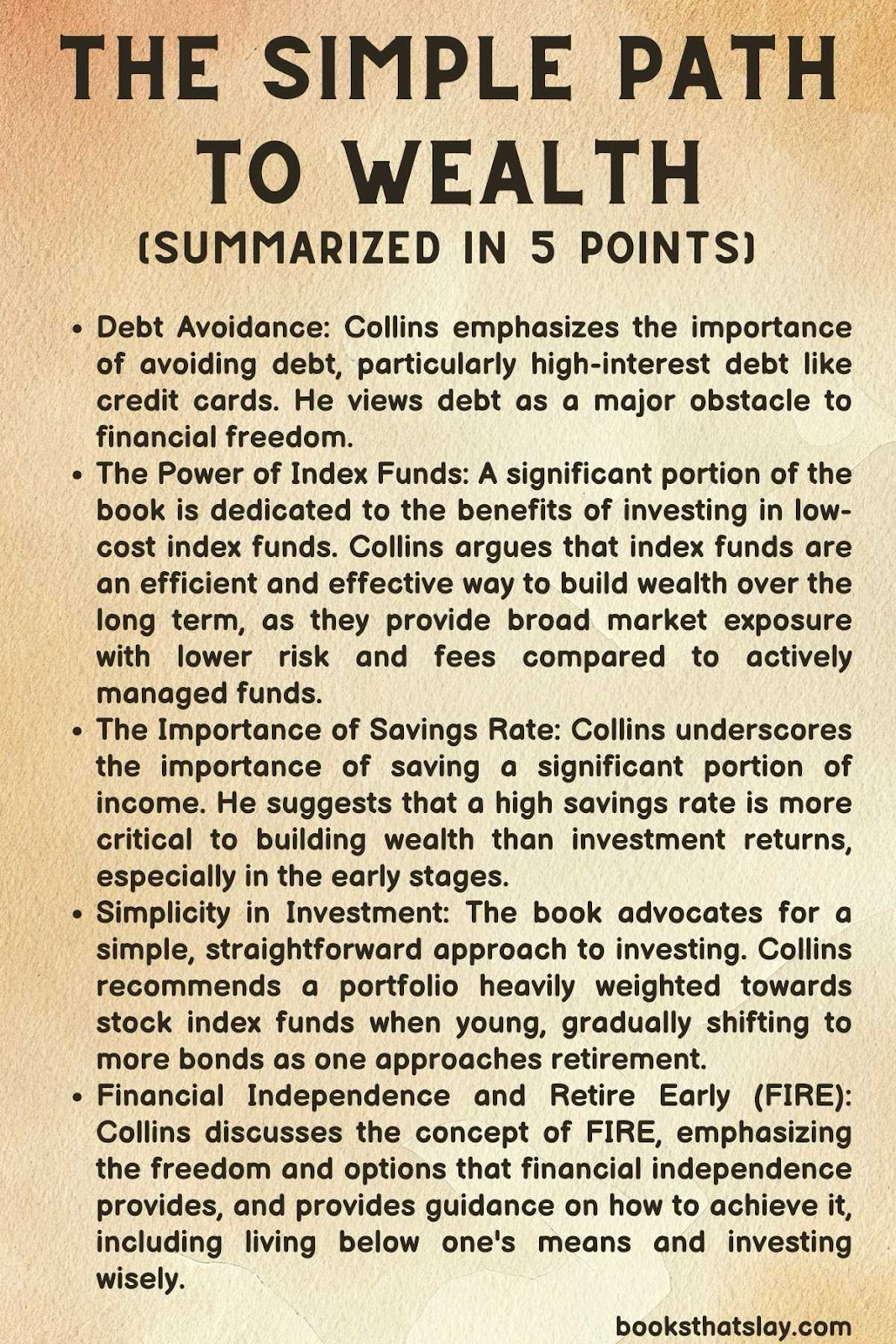

The book presents a straightforward approach to achieving financial independence through saving, investing in low-cost index funds, and avoiding debt. It emphasizes the power of compounding, frugality, and long-term investment strategies to build wealth steadily and securely.

The Simple Path To Wealth Summary

The Importance of Financial Independence

Collins emphasizes the importance of financial independence as a primary goal. He advocates for a lifestyle that prioritizes saving and investing over high consumption.

The book begins by establishing the foundational mindset necessary for wealth accumulation, stressing the freedom and choices that financial independence affords. Collins encourages us to think about how they want to live their lives and to use their financial goals as a means to support those life choices.

The Power of Index Funds

A significant portion of the book is dedicated to explaining why low-cost index funds, particularly those tracking the stock market as a whole, are the most effective tools for most investors. Collins critiques more complex and actively managed investment strategies, arguing that they often lead to higher fees and lower returns.

He emphasizes the efficiency, simplicity, and effectiveness of index fund investing, particularly for those who are not interested in actively managing their investments.

Debt and Wealth Accumulation

Collins provides a comprehensive look at how debt impacts wealth building. He makes a strong case against incurring high-interest debt, such as credit card debt, and outlines strategies for paying off debt.

However, he also recognizes that certain types of debt, like a mortgage, can be acceptable or even beneficial in the context of overall financial planning.

Frugality and Expense Management

A key theme throughout the book is the role of frugality and managing expenses in wealth accumulation. Collins argues that controlling spending is more crucial than earning a high income.

He advocates for living below one’s means and investing the surplus. The book offers practical advice on budgeting, cutting unnecessary expenses, and prioritizing spending in a way that aligns with personal values and long-term financial goals.

Wealth Preservation and Withdrawal Strategies

In the later sections, Collins shifts focus to wealth preservation, particularly for those nearing or in retirement. He discusses strategies for responsibly withdrawing from investment portfolios, maintaining a balance between preserving capital and enjoying the fruits of one’s labor.

The book covers concepts like the 4% rule, tax efficiency, and adjusting asset allocation over time to manage risk.

Also Read: The Song of Achilles Summary and Key Lessons

Key Lessons

1. Investing in Low-Cost Index Funds is a Key to Building Wealth

Simplicity and Efficiency: Collins strongly advocates for the use of low-cost index funds as the cornerstone of an investment strategy. He explains that these funds, which track market indices like the S&P 500, offer a simple and effective way to invest in the broad stock market. Unlike actively managed funds, index funds have lower fees and typically outperform actively managed funds over the long term.

Diversification: Index funds inherently provide diversification, spreading your investment across hundreds or thousands of stocks. This diversification reduces risk by not being overly dependent on the performance of any single company or sector.

Long-Term Perspective: The book emphasizes a long-term approach to investing, encouraging readers to stay the course during market fluctuations. By investing consistently in index funds and avoiding the temptation to time the market, investors can benefit from the market’s overall upward trend over time.

2. The Importance of Living Below Your Means and Saving Diligently

Frugality as a Path to Freedom: One of the core principles in the book is the importance of living below your means. Collins highlights that accumulating wealth isn’t just about how much you earn, but more importantly, about how much you save and invest. By adopting a frugal lifestyle, you can save a significant portion of your income.

The Power of Compounding: The book illustrates the power of compounding interest, showing how savings can grow exponentially over time. Starting to save and invest early in life can have a profound impact on your financial future, as the returns on your investments compound over the years.

Avoiding High-Interest Debt: Collins advises readers to avoid high-interest debt, such as credit card debt, which can quickly erode financial stability. He suggests prioritizing debt repayment, particularly for high-interest debts, as an essential step towards financial freedom.

Also Read: The Cask of Amontillado Summary and Key Lessons

3. Strategies for Wealth Preservation and Retirement Planning

The 4% Rule: For retirement planning, Collins discusses the 4% rule as a guideline for withdrawal rates. This rule suggests that you can withdraw 4% of your retirement portfolio annually (adjusted for inflation each year) with a low risk of running out of money over a 30-year retirement period.

Asset Allocation Adjustments: As you approach and enter retirement, Collins recommends adjusting your asset allocation to be more conservative, gradually shifting from stocks to bonds to reduce volatility and protect your capital.

Tax Efficiency in Retirement: The book also covers strategies for tax-efficient withdrawals from different types of retirement accounts (like 401(k)s, IRAs, and Roth IRAs), helping to maximize the value of your savings in retirement.

Final Thoughts

“The Simple Path to Wealth” is praised for its clear, concise advice and its accessible approach to complex financial concepts. It demystifies investing and personal finance, making it an excellent resource for beginners.

Collins’ emphasis on simplicity and long-term thinking aligns well with the principles of many successful investors and is especially relevant in today’s volatile financial climate. The book’s practical advice is grounded in the belief that financial independence is achievable for most people through disciplined saving and smart investing.

Read our other summaries