One Up On Wall Street Summary and Key Lessons

“One Up on Wall Street” is a seminal book on investing written by Peter Lynch, a highly successful fund manager known for his work with the Magellan Fund at Fidelity Investments.

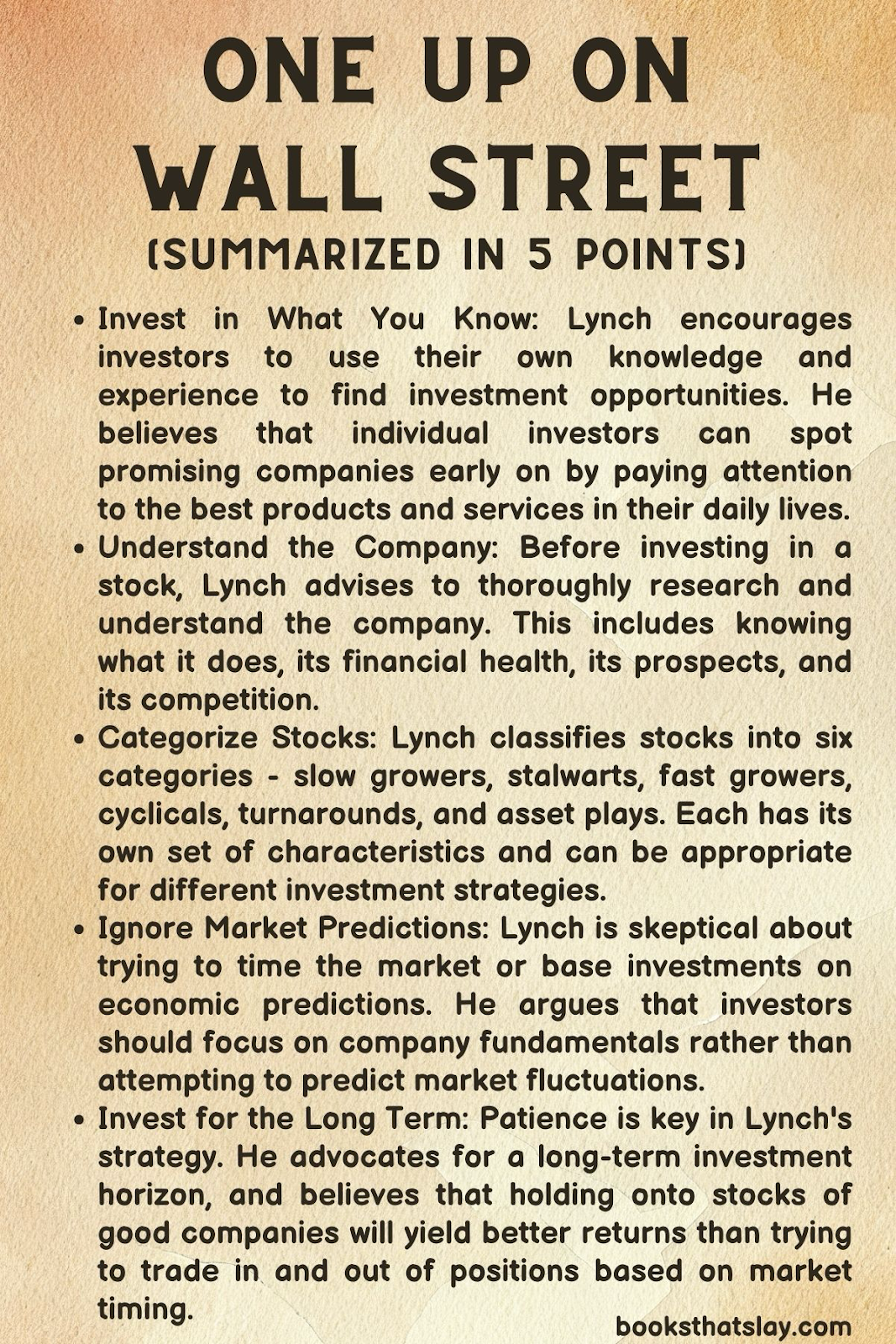

Quick Summary: The book emphasizes the advantages individual investors have over large institutions. It encourages investing in familiar, understandable companies and outlines a pragmatic approach to selecting stocks based on one’s own experiences, with a focus on long-term growth and company valuation.

One Up On Wall Street Summary

Knowing What You Own

Lynch emphasizes the importance of understanding the businesses behind stocks. He encourages investors to invest in what they know, drawing on their own experiences and insights as consumers, classifying companies into six categories – slow growers, stalwarts, fast growers, cyclicals, turnarounds, and asset plays – each with its own set of characteristics and investment considerations.

- Slow Growers: Mature companies that offer modest growth potential but may provide reliable dividends.

- Stalwarts: Large, well-established companies that offer steady growth and resilience during economic downturns.

- Fast Growers: Small, aggressive new enterprises with above-average growth rates.

- Cyclicals: Companies whose revenues and profits rise and fall in predictable patterns based on economic cycles.

- Turnarounds: Companies in distress that may provide rewarding investments if they manage to recover.

- Asset Plays: Companies with valuable assets that may be overlooked by the market.

Lynch’s investing philosophy is rooted in the belief that individuals can spot investment opportunities in their everyday lives long before Wall Street catches on. He suggests that by focusing on what they can understand, investors can use their knowledge to identify promising companies early.

Fundamental Analysis for Everyone

Lynch is a firm believer in doing the right amount of homework.

Fundamental analysis is key to his approach, focusing on the financial health and prospects of a company rather than relying on market trends or analyst opinions.

He outlines what he calls “the two-minute drill,” where an investor should be able to explain why they own a stock in simple terms that a child could understand, covering the core idea behind the business, what will drive its success, and potential challenges.

Lynch introduces several key ratios and metrics for evaluating companies, including the price-to-earnings (P/E) ratio, debt-to-equity ratio, and free cash flow.

He instructs investors to look for companies with strong balance sheets, good management, and competitive advantages.

The Long-Term View

Investing, according to Lynch, is most fruitful as a long-term endeavor. He warns against trying to time the market or react to short-term volatility.

Instead, investors should look for companies that they can hold onto for years, benefiting from their growth.

Lynch also warns against “diworseification,” where a company’s management diversifies into areas outside of their expertise, often leading to a decline in the company’s performance.

He prefers companies that stick to what they know and do best.

When to Sell

One of the most challenging aspects of investing is knowing when to sell a stock. Lynch offers clear guidelines for when an investor should consider selling:

- When the fundamentals that made a company attractive in the first place have deteriorated.

- If there are significant and persistent management issues.

- When a better investment opportunity presents itself, and the funds are needed to make that investment.

- If the stock has become significantly overvalued relative to its earnings prospects.

However, he also cautions against selling simply because the stock has gone up or because of a temporary downturn in the market.

The Investor’s Edge

Lynch believes that individual investors have certain advantages over institutional investors. They can afford to invest in smaller companies that are too small for large funds to invest in.

They also don’t face the same pressures as professional investors who must show consistent short-term performance.

He encourages investors to trust their own judgment and research, avoid following the crowd, and to invest in a disciplined and methodical way.

Also Read: Girl Stop Apologizing Summary and Key Lessons

Key Lessons

1. Invest in What You Know

Personal Expertise as an Advantage: Lynch advocates for using one’s own professional and personal experiences as a filter for investment opportunities. For instance, if you work in the healthcare industry, you might be better positioned to understand which pharmaceutical companies have the potential for growth.

Leverage Consumer Experience: Everyday interactions with products and services can lead to valuable insights. If you notice a particular brand is becoming popular or a service is experiencing increased demand, it could be an early indicator of investment potential.

Understanding Leads to Confidence: By investing in familiar territories, you can more easily interpret company news, understand product cycles, and stay the course when markets fluctuate, because you have a fundamental belief in the business’s long-term value.

2. Do Your Homework

Fundamental Analysis: Lynch’s success was largely due to his rigorous examination of a company’s financial health. He stresses the importance of looking at financial statements, earnings reports, and industry trends.

Key Metrics to Examine: Some metrics Lynch suggests include P/E ratios, debt-to-equity ratios, cash flow, profit margins, and inventory levels. By understanding these figures, you can make more informed decisions rather than relying on hearsay.

Regular Monitoring: Once you’ve invested, it’s crucial to keep up with the company’s quarterly and annual reports, news releases, and major changes in management or strategy.

This information will help you decide whether to hold, sell, or buy more.

Also Read: Grain Brain Summary and Key Lessons

3. Patience is Key

Long-Term Investment Strategy: Lynch is a proponent of the ‘buy and hold’ strategy, arguing that true growth and compounding returns are realized over many years, not months.

Avoid Market Timing: Attempting to predict short-term market movements is a fool’s errand. Instead, focus on the company’s fundamentals, and stay invested through the market’s inevitable ups and downs if those fundamentals remain strong.

Recognizing and Avoiding Psychological Traps: Many investors sell their winners too early out of fear and hold onto their losers hoping they will bounce back. Lynch advises against these emotional responses, suggesting that a rational long-term view based on company performance is more effective.

Final Thoughts

In conclusion, “One Up on Wall Street” is a guide for individual investors who want to leverage their own knowledge and insights to invest successfully in the stock market.

Lynch’s approach is centered on understanding what you own, conducting thorough fundamental analysis, maintaining a long-term perspective, knowing when to sell, and using your advantages as an individual investor.

Read our other summaries