Barbarians at the Gate Summary and Key Lessons

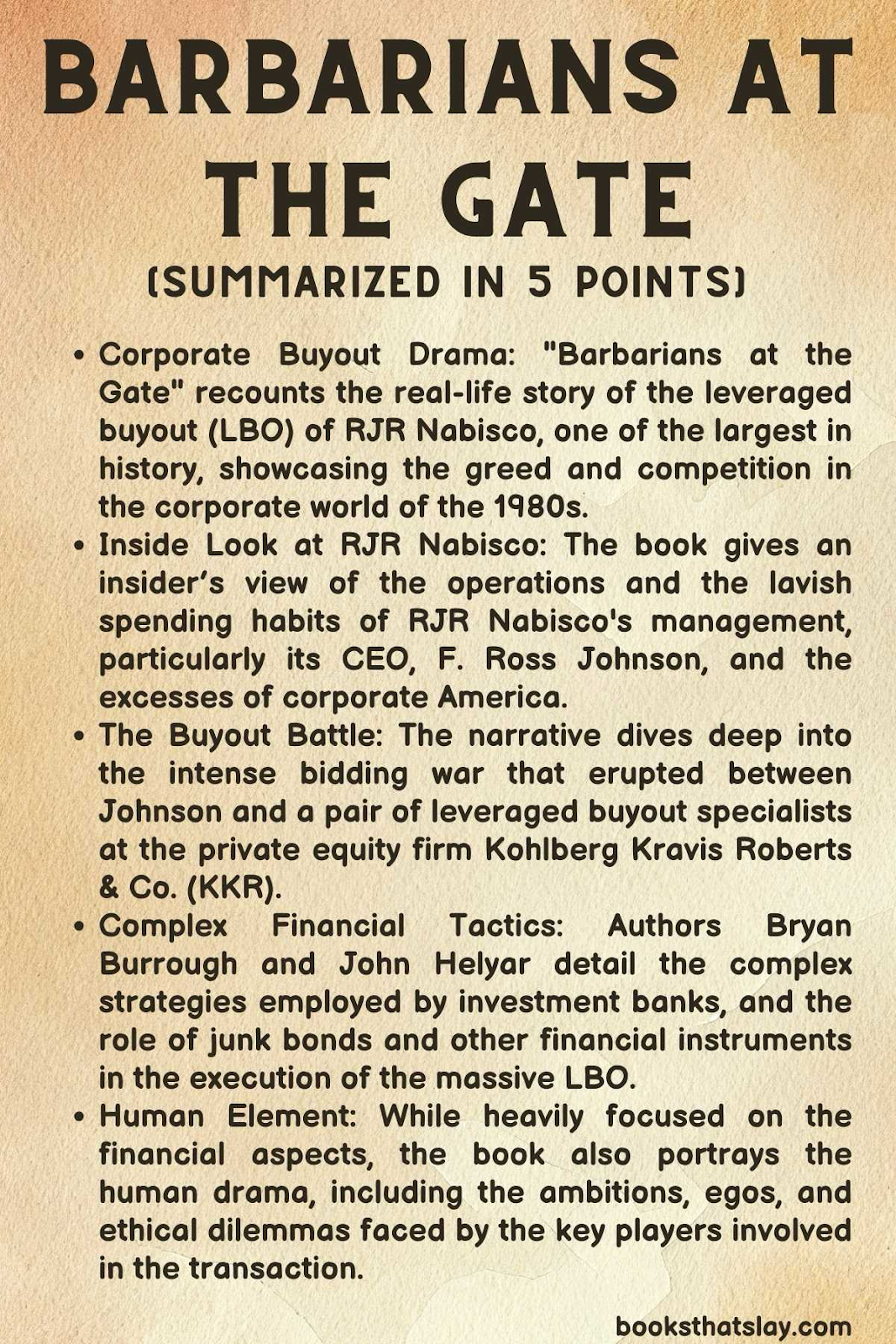

“Barbarians at the Gate: The Fall of RJR Nabisco” is an investigative book by Bryan Burrough and John Helyar that chronicles the fierce battle for control over RJR Nabisco in the late 1980s, one of the largest and most brutal corporate takeovers in American history.

The book delves into the complexities and excesses of Wall Street during this era, portraying the leveraged buyout (LBO) of RJR Nabisco as a defining event that showcased the culmination of greed, ambition, and the high-stakes gambling nature of financial markets.

Barbarians at the Gate Summary

The story is set against the backdrop of a booming American economy and a deregulated financial environment where RJR Nabisco’s CEO, F. Ross Johnson, emerges as the protagonist.

Johnson, a charismatic and aggressive executive, decides to pursue a leveraged buyout of his company to thwart potential takeovers after a series of strategic missteps.

He teams up with the investment firm Shearson Lehman Hutton and his deputy, Peter Cohen, to make an offer that would effectively take the company private, intending to shield it from the market pressures and secure his own future within the corporation.

The initial bid is a staggering $17 billion, an unprecedented sum at the time, which sets off a frenzy on Wall Street.

What follows is an intense bidding war that draws in a range of characters from the world of high finance.

The narrative becomes a thrilling race as different parties vie for the prize.

On one side is the infamous private equity firm Kohlberg Kravis Roberts & Co. (KKR), led by the shrewd and tenacious Henry Kravis. Kravis, feeling betrayed by Johnson who approached him for advice before turning to Shearson, enters the fray with a determination to win at all costs.

The competition escalates as KKR makes a counteroffer, leading to a series of increasingly aggressive bids that inflate the company’s value to dizzying heights.

Each bid is more leveraged than the last, showcasing the era’s penchant for risky financial strategies and the belief that debt could be endlessly piled on with little consequence.

The authors meticulously detail the intricate financial maneuvers and the personal dramas that unfold as the takeover battle intensifies.

They paint a picture of a Wall Street culture rife with avarice, exemplified by lavish lifestyles, casual million-dollar bets, and a relentless pursuit of wealth.

As the LBO process becomes more convoluted, the players involved engage in clandestine meetings, public relations battles, and complex negotiations. There are detailed accounts of the grueling due diligence, the manipulation of public perception, and the intricate financial modeling that drives the decision-making of the investment banks, the LBO firms, and RJR Nabisco’s own board of directors.

Ultimately, “Barbarians at the Gate” is a cautionary tale of hubris and financial excess. The eventual victory by KKR comes at a staggering final price of $25 billion, marking it as one of the most expensive takeovers in history at the time.

However, the success comes at a huge cost.

The immense debt burden placed on RJR Nabisco severely hampers its operation and growth, highlighting the risks and unsustainability of leveraged buyouts.

The book concludes with a reflective commentary on the socio-economic impact of such takeovers, questioning the value and morality of a system that allows, and even celebrates, such predatory and speculative financial practices.

Also Read: The Almanack of Naval Ravikant Summary and Key Lessons

Key Lessons

1. The Risks of Leveraged Buyouts and Excessive Debt

The RJR Nabisco LBO became a textbook example of how excessive debt can cripple a company’s ability to operate effectively post-acquisition.

While leverage can amplify returns, it also increases the risk of insolvency during downturns or when cash flows are unable to service the debt burden.

The key takeaway here is to understand the balance between using debt to leverage returns and maintaining a manageable level of debt that does not endanger the company’s financial stability.

This lesson is not only applicable to corporate finance but can also be extended to personal finance where managing debt responsibly is crucial for long-term financial health.

2. Corporate Governance and Ethical Leadership

The actions of RJR Nabisco’s CEO F. Ross Johnson, including his initial offer that was designed to benefit himself and his inner circle, underscore the importance of strong corporate governance and ethical leadership.

The book exposes the conflicts of interest and the lack of accountability at the top levels of the corporation, where personal greed overshadowed fiduciary responsibilities.

An important lesson for businesses and leaders is the significance of establishing a robust corporate governance structure that ensures that management’s actions are aligned with the interests of all stakeholders, including shareholders, employees, and the community.

Ethical leadership is critical to sustain and protect the integrity and reputation of an institution.

Also Read: Chasing The Scream Summary and Key Lessons

3. The Unintended Consequences of Financial Innovation

The book showcases the complexity of financial instruments and strategies that were innovative at the time, such as junk bonds and high-yield securities, which played a pivotal role in financing the LBO.

These financial innovations, while useful in providing the necessary capital, also contributed to creating a highly speculative environment that led to one of the most infamous bubbles and subsequent crashes.

The lesson here is that financial innovation needs to be approached with caution and a deep understanding of the long-term implications.

Investors, managers, and regulators must critically assess the systemic risks that can arise from the widespread adoption of novel financial products and strategies, to prevent potential crises.

This insight is particularly relevant in times of rapid financial innovation, such as the rise of cryptocurrencies and other complex financial technologies.

Final Thoughts

“Barbarians at the Gate” is a seminal work that reads like a corporate thriller, capturing an iconic moment in financial history.

The book is not just a chronicle of a significant business event but also serves as a cautionary tale about the perils of hubris and the complexities of Wall Street. The authors succeed in turning intricate financial maneuvers into an engaging narrative that is both educational and entertaining, making it a must-read for those interested in understanding the machinations behind major corporate deals.

Read our other summaries